Q1 2024 – Opportunity for Investment in Canadian Agribusiness

Download PDF

Opportunity for Investment in Canadian Agribusiness

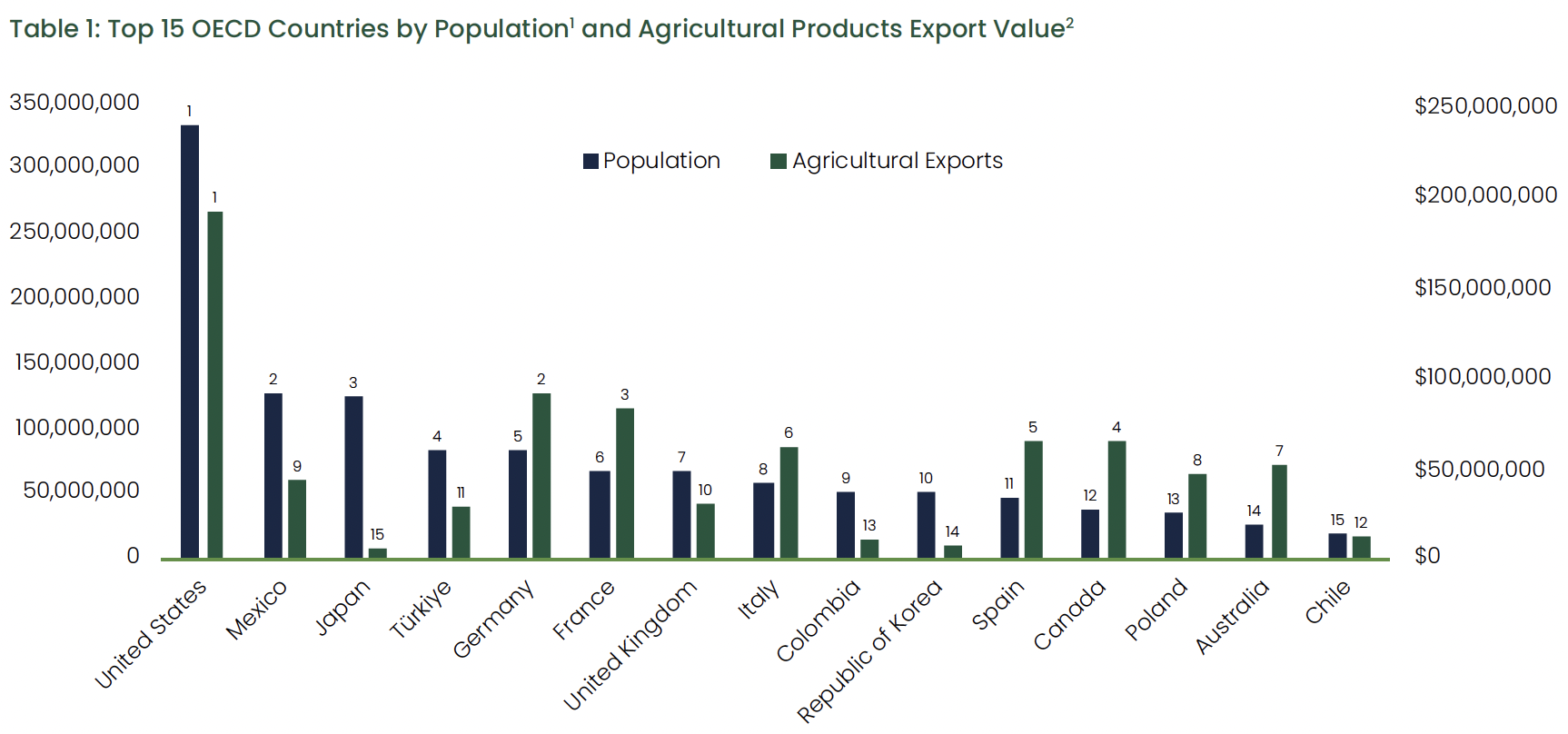

Sophisticated investors are increasingly looking at Canada’s agricultural industry for attractive, diversified opportunities. In the global context, Canada’s agriculture and agri-food industry punches well above its weight. Despite ranking as the 12th largest OECD nation by population, Canada is the world’s fifth largest agricultural exporter and the fourth largest exporter amongst OECD countries.(1) We take our role in sustainably feeding the world seriously, operating within a robust regulatory framework that upholds best-in-class governance and operating practices. However, despite these dynamics Canadian producers and processors suffer from chronic underinvestment due to a lack of access to capital, hindering growth and leading to industrywide inefficiencies, which creates an attractive environment for investment.

There has been a lot of recent discussion about Canada’s anemic rate of capital investment. According to OECD data, between 2011 to 2015, the rate of investment in Canada was among the bottom third of member nations, placing 37 out of 47. The situation worsened from 2015 to 2023, in which Canada dropped to 44 out of 47 nations. This trend impacts all industries, including agriculture, where Bonnefield has witnessed the pressing need for capital firsthand. For the last 15 years, Bonnefield has forged strong, trusting relationships with Canadian farmers, providing them with alternative financing solutions to enable their continued growth. Through these relationships, Bonnefield has seen the need for capital investment beyond farmland, across the entire agricultural value chain. We recently launched a fund to address this need by providing noncontrolling growth capital to a broader range of agribusiness in

Canada.

Size of the Opportunity

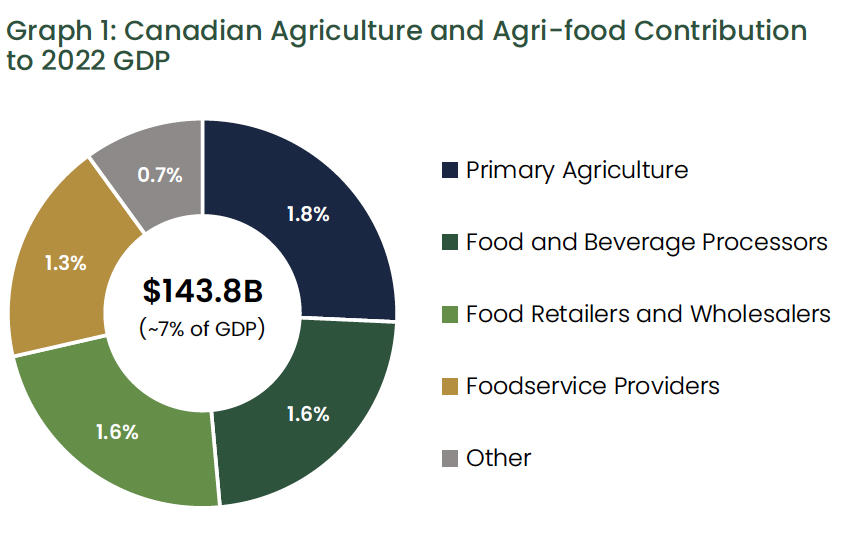

The agriculture and agri-food industries are among the largest sectors of the Canadian economy, accounting for approximately 7% of GDP and employing 2.3 million people in 2022.(3) There are over 8,500 Canadian food and beverage processing companies alone(4), many of which are continuing to expand both domestically and

internationally to meet growing demands. Today approximately half of everything that Canadian agriculture and agri-food produces is exported as either primary commodities or processed food and beverage products.(5) Increasing demand for food products, driven by population growth, underscores the potential for investment in Canadian agribusinesses. The global population is projected to reach nearly 10 billion by 2050, necessitating a substantial increase in food production to meet growing demand, with current projections expecting an increase in global food demand by 35% to 56% between 2010 and 2050.(6) Meeting this increased demand will be especially challenging in the face of climate challenges and declining crop yields, two factors that are competitive advantages for Canada. With our extensive agricultural production and sector expertise, there is potential to unlock outsized growth in Canada and further our position as a globally recognized, trusted agricultural trade partner.

Today approximately half of everything that Canadian agriculture and agri-food produces is exported as either primary commodities or processed food and beverage products.5 Increasing demand for food products, driven by population growth, underscores the potential for investment in Canadian agribusinesses. The global population is projected to reach nearly 10 billion by 2050, necessitating a substantial increase in food production to meet growing demand, with current projections expecting an increase in global food demand by 35% to 56% between 2010 and 2050.6 Meeting this increased demand will be especially challenging in the face of climate challenges and declining crop yields, two factors that are competitive advantages for Canada. With our extensive agricultural production and sector expertise, there is potential to unlock outsized growth in Canada and further our position as a globally recognized, trusted agricultural trade partner.

How (and Where) to Invest

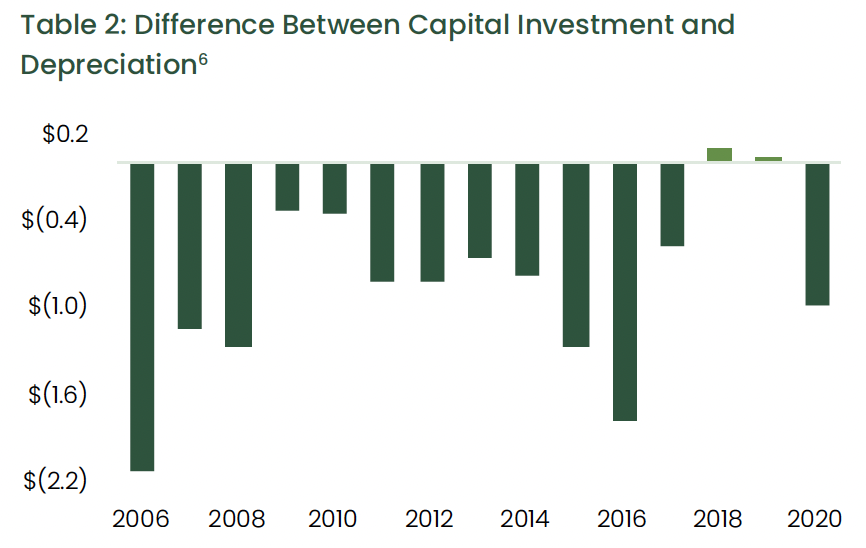

In 2017, the Canadian federal government’s Advisory Council on Economic Growth released a set of recommendations to improve Canada’s economic growth trajectory. This report, which is commonly referred to as “the Barton Report”, identified agriculture and agri-food as one of the key sectors with potential to drive substantial economic growth and increase exports. Since that time, however, we have seen limited investment in the sector relative to demand from producers and the opportunity for attractive returns. Increasing exports is critical to the future success of Canadian agriculture and agri-food and requires investment to enable expansion of operations and enhancement to storage, transportation, processing, and manufacturing capabilities. This investment will allow Canadian operators to capture a greater share of the value created in the broader value chain. To date, underinvestment has posed challenges for the sector’s ability to grow and meet expanding demand. Investment in the food processing industry as a percentage of revenue decreased by ~50% from 1998 to 2016.(7)As depicted in the graph below, annual capital investment in agricultural equipment and machinery has lagged depreciation (i.e. the investment required just to replace aging equipment) over the last 15 years by a cumulative $12.9 billion(8).

These challenges for Canadian agribusinesses present an opportunity for investors to fill the investment gap and drive growth in the sector. Investing in modernizing agricultural infrastructure, and investments in value-added processing facilities can unlock new opportunities for growth and innovation, and enable producers to tap into growing export demand. By investing in Canadian agribusinesses, investors can not only generate attractive returns but also contribute to the growth, sustainability, and competitiveness of Canada’s agriculture and agri-food sectors, ensuring a prosperous future for Canadian agriculture.

The Bonnefield Agribusiness Fund

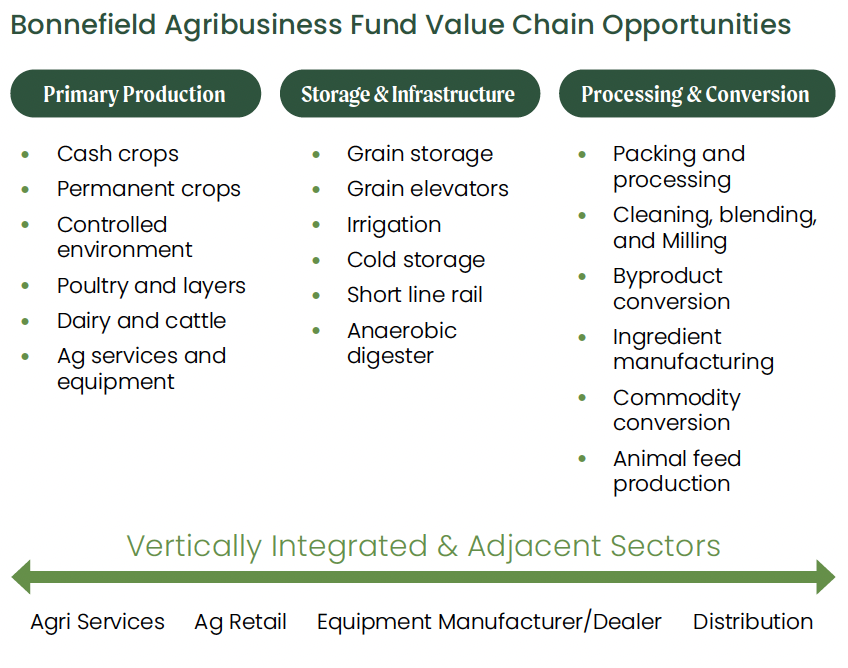

With nearly 15 years’ experience supporting Canadian farmers with land-based financing solutions, the team at Bonnefield has seen significant opportunities to support the growth and capital needs of leading agribusiness operators across the value-chain. For this reason, we launched the Bonnefield Agribusiness Fund LP I (“Agribusiness Fund”) in 2023, to invest in established, lower-middlemarket agribusinesses with significant growth opportunities.

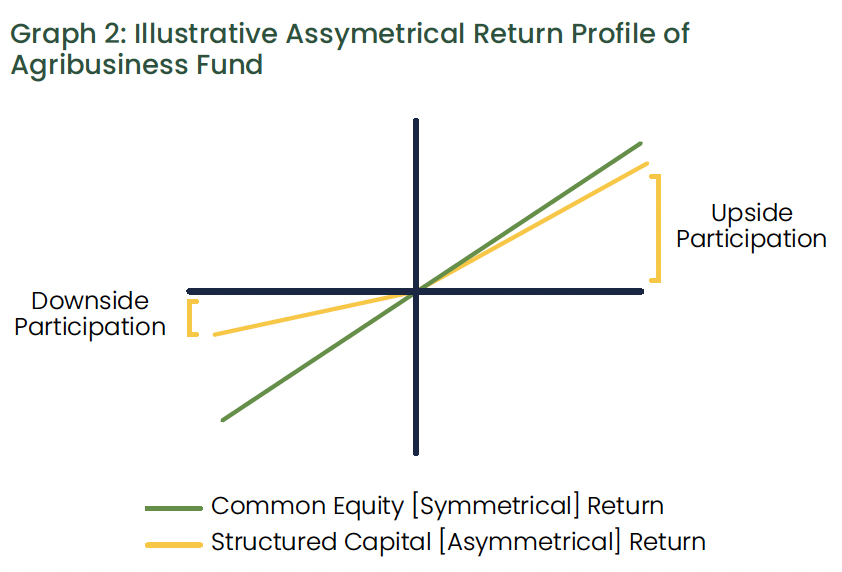

Bonnefield’s Agribusiness Fund invests non-controlling capital through structured solutions, including subordinated debt, preferred equity, and/or equity with warrants, as well as facilitating sale-leaseback arrangements on vital agricultural infrastructure. Bonnefield’s approach is to be a customizable capital solution for business owners across the agricultural value chain. We use structured capital to minimize downside risk to investors, while participating in some of the upside from equity value creation. Bonnefield has deep industry roots and expertise in Canadian agriculture, with long-established agricultural operating partners. This experience provides unparalleled access to investment opportunities with agri-business owners who see Bonnefield as a value-add partner that brings more than just capital – our robust network of farm operators and industry experts that we can leverage to support their growth.

We see an attractive opportunity to invest in leading Canadian agribusinesses while providing attractive risk-adjusted returns to our

investors. We are excited to be able to support the long-term growth and expansion of Canada’s agriculture and agri-food global

footprint. The launch of Bonnefield’s Agribusiness Fund reaffirms our dedication to advancing the future of Canadian agriculture.

For information on the Bonnefield Agribusiness Fund please reach out to investors@bonnefield.com

About Bonnefield Financial

Bonnefield is a leading Canadian natural capital investment manager that invests in farmland and agribusinesses. We provide capital to progressive farmers and agribusiness operators through land-lease financing and non-controlling equity solutions. Bonnefield is dedicated to preserving farmland for farming and promoting sustainable production practices. The firm partners with growth-oriented farmers and agribusiness operators to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long-term future of Canadian agriculture. www.bonnefield.com

Sources

1. The World Bank. United Nations Population Division. World Population Prospects: 2022 Revision.

2. Food and Agriculture Organization of the United Nations. FAO Statistics Division – Total Agricultural Products, excluding fishery and forestry products.

3. Government of Canada. Overview of the Canadian agri-food system.

4. Government of Canada. Overview of the food and beverage processing industry.

5. Canadian Agri-Food Trade Alliance. Agri-Food Exports.

6. van Dijk, M., Morley, T., Rau, M.L. et al. A meta-analysis of projected global food demand and population at risk of hunger for the period 2010–2050. Nat Food 2, 494–501 (2021).

7. Statistics Canada. Table 34-10-0278-01 Historical (real time) releases of capital and repair expenditures, non-residential tangible assets, by industry and geography (x 1,000,000).

8. Statistics Canada. Table 34-10-0036-01 “Capital and repair expenditures, non-residential tangible assets by industry (x 1,000,000)”; Table 32-10-0049-01 ”Farm Operating Expenses and Depreciation Charges (x 1,000).

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment.