Download PDF

Harvesting New Opportunities: Growing Our Investment Footprint with Okanagan Cherries

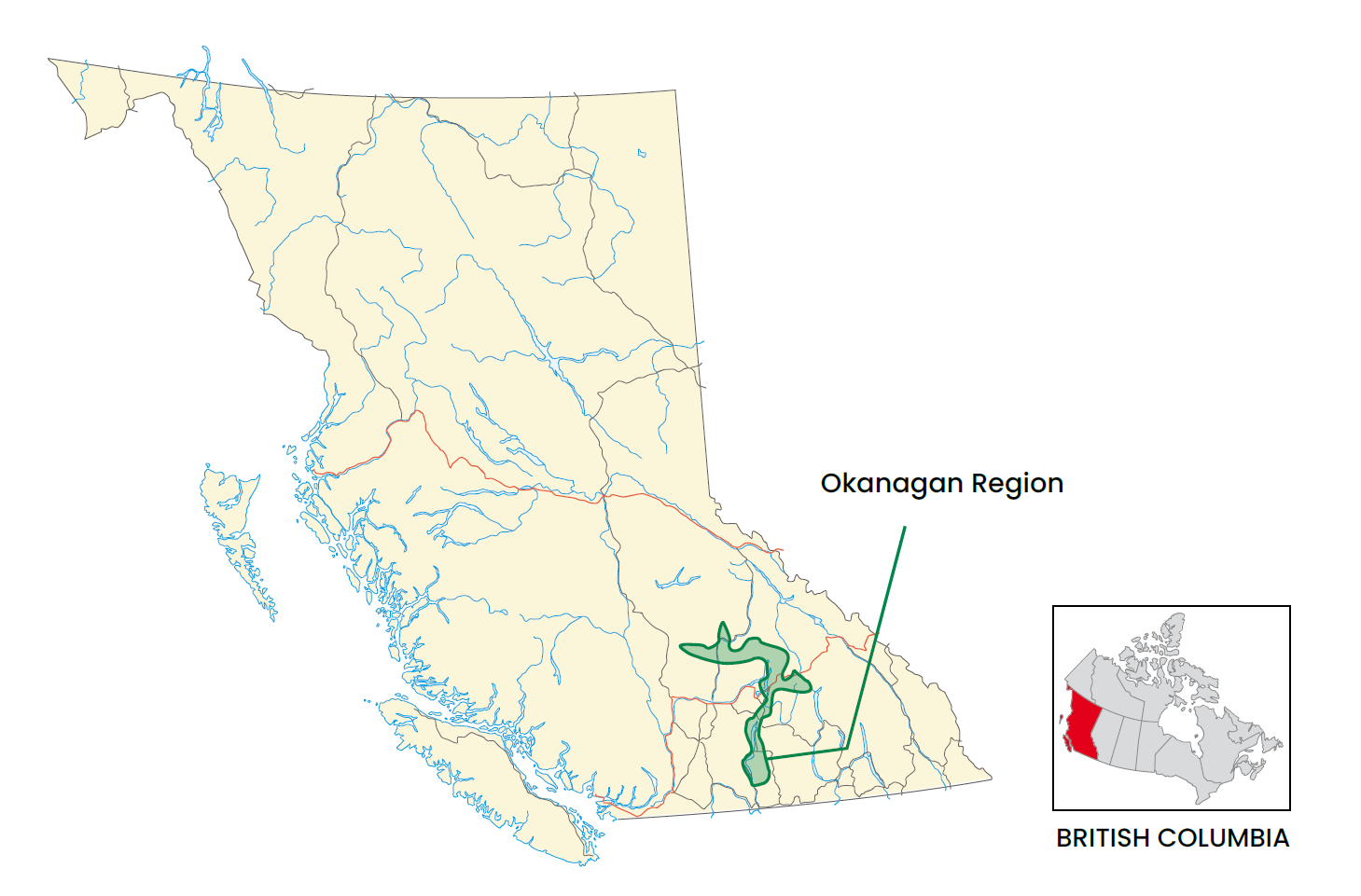

2024 has been an exciting year for Bonnefield, as we continue to support Canadian farmers by expanding our investment footprint into new geographies and agricultural regions. In this newsletter, we highlight one of our most recent investments in a cherry orchard in the Okanagan region of British Columbia, Canada, and provide an overview of the key considerations between row crop and permanent crop investments.

Crop Selection for Farmland Investment

Bonnefield’s investment philosophy is to build a diversified portfolio of high-quality Canadian farmland and partner with operationally and financially strong operators. Similar to the Canadian agriculture landscape, our strategy is more heavily weighted towards traditional row crops and specialty crops, with modest exposure to permanent crops.

While many farmland investment managers in Canada and the United States specialize primarily in either row crops or permanent crops, Bonnefield offers our investors diversified exposure to both row and permanent crops across top agricultural regions in Canada. We build broadly diversified portfolios in order to mitigate risk, provide a smoothing of returns, and provide maximum optionality for our value creation activities.

Investing across a diversified geography and multiple crop types, however, requires a thorough understanding of each region, crop, and the unique considerations that come with them.

Understanding the Difference in Risks – Permanent vs. Row Crops

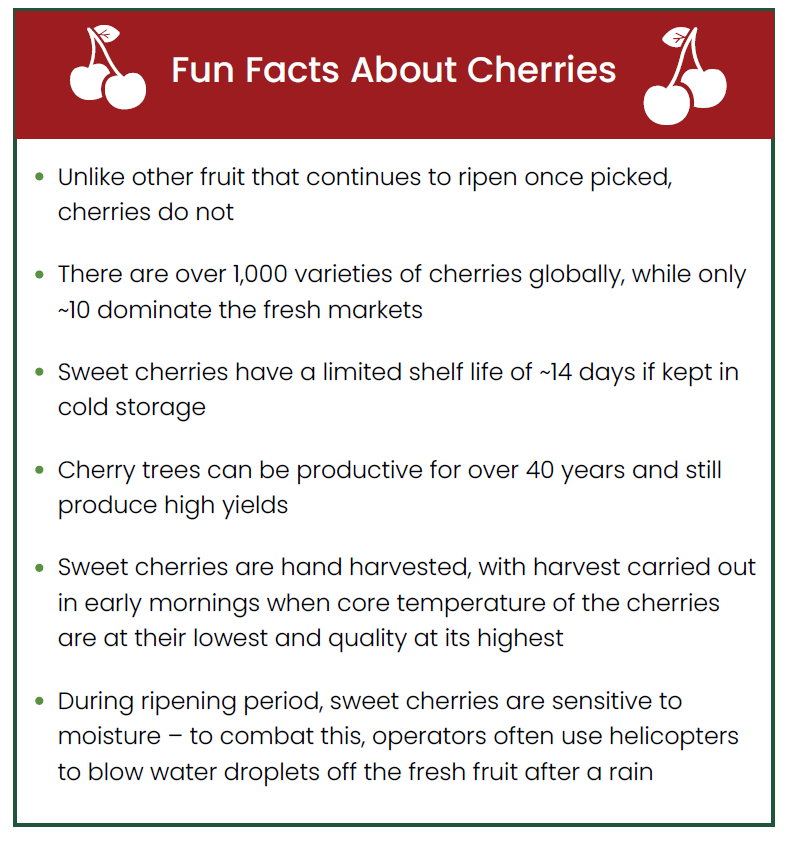

Permanent crops, such as fruit trees like cherries and apples, and bush plants like blueberries and raspberries, are perennial plants that produce the same commodity year after year. In contrast, row crops like wheat or canola are planted and harvested annually, allowing producers to rotate the crop grown each year. Understanding the production, pricing and end markets, as well as the unique risks associated with permanent crops versus row crops is critical to evaluating a potential investment.

Compared with row crops, lands that produce permanent crops tend to be valued on a higher dollar-per-acre basis as a result of the higher prices and gross margins that permanent crops can generate. However, these higher prices come with a number of additional risks and potential costs. Firstly, permanent crops require significant upfront investment to establish the plant, with some plants taking several years to reach full production. Secondly, permanent crops also require a higher level of ongoing farm management, requiring specialized equipment and they can be more labour intensive compared with row crops. Finally, because permanent crops rely on the ongoing health of the plant to produce year after year, there are increased risks from disease, pests and adverse weather to a permanent crop operation versus that of row crops.

Bonnefield mitigates the risks related to permanent crops through diligent research, partnership with leading and established operators, and investing in a diversified portfolio of high-quality properties. Customizing the structures of our capital investment and leases are also important to ensure appropriate risk-adjusted returns.

Identifying an Opportunity in BC Cherries

Bonnefield is constantly monitoring macroeconomic and industry trends to identify attractive areas across Canada to invest. These opportunities typically come to us from Canadian farmers looking to grow or support their succession planning and feel that they can benefit from Bonnefield’s capital solutions. Our recent investment in the Okanagan region of British Columbia highlights how we approach entering a new region.

Earlier this year, our team connected with a leading cherry producer in British Columbia. This family farming business was seeking to expand its partnerships, as it looked to improve its balance sheet following a recent business expansion. The team conducted significant industry research and on-the-ground diligence into the tender fruit growing regions in British Columbia and determined that cherries grown in the Okanagan region were an attractive opportunity, partly due to the competitive advantage that the region has with its late growing season, creating a unique window where the region is the only supplier of fresh cherries to the global market for several weeks each fall. Alongside its comprehensive diligence into farm operations and operators, Bonnefield conducted a critical analysis of historical weather patterns to assess current weather trends in the regions.

Bonnefield collaborated closely with the operator to see how our capital solutions could support their growth and agreed to enter into a sale leaseback on 114 acres of cherry land. Our partner in this venture is one of Canada’s largest sweet cherry producers, boasting a robust export presence. This collaboration not only strengthens exposure to a key agricultural region but also offers our investors added diversification and increased yields within their farmland portfolios.

We are excited about the growth potential and the value this new region brings, and continuing to deliver attractive, stable returns to our investors while supporting our farm partners to strengthen and grow their operations.

For information on the Bonnefield Farmland Funds, please reach out to investors@bonnefield.com

About Bonnefield Financial

Bonnefield is a leading Canadian farmland and agribusiness investment manager. We provide capital to progressive farmers and agribusiness operators through land-lease financing and non-controlling equity solutions. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers and agribusiness operators to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long-term sustainable future of Canadian agriculture.

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment. This communication is for informational purposes only and should not be relied upon for completeness. Any investment performance data outlined in this document should not be used to predict future returns. Any market prices, data, and third-party information are not warranted as to completeness or accuracy and are subject to change without notice. Prospective investors should take appropriate professional advice before making any investment decision. In all cases where historical performance is presented, note that past performance is not indicative of future results, and should not be relied upon as the basis for making an investment decision. There can be no assurance that any unrealized investments will ultimately be realized at the valuations taken into account in calculating the Funds performance presented herein, where applicable. The performance of such investments when ultimately realized may be materially different. This document may not be transmitted, reproduced, or used in whole or in part for any other purpose, nor may it be disclosed or made available, directly or indirectly, in whole or in part, to any other person without Bonnefield’s prior written consent.

Copying, distributing or sharing this document or its contents is expressly prohibited without the express, written consent of Bonnefield.