Download PDF

Time to Bet on the Farm? The Growing Appeal of Farmland for High Net Worth Investors

In recent years, headlines about pension plans and seasoned investors like Bill Gates and Warren Buffett investing in farmland have sparked interest in the asset class. Unlike traditional stocks and bonds, many investors are unsure how to approach farmland investments. Is it merely the latest high-profile trend, or is there more to its appeal?

The reality is that farmland has been an attractive investment for centuries. Individuals worldwide have acquired farmland as a means of long-term wealth generation and to preserve wealth through uncertain times. However, not everyone has the means to buy and manage a farm. To address this, opportunities to invest in portfolios of farmland assets have emerged, facilitating investment with additional diversification exposure across multiple growing regions.

Over the last few decades, institutional investors have led the charge in global farmland investment. Now, increasing numbers of individuals are adding farmland to their investment portfolios. The interest is rooted in the asset’s unique performance features as well as attractive macro-economic dynamics driving value as outlined below.

The Essential Nature of Farmland

Food is a necessity, and farmland is critical to the production of crops that are required not just to meet the food consumption demands of a growing population, but also to meet demands for livestock feed and alternative energy sources. Globally, the amount of arable land is expected to decline by 50 million hectares (picture 100 million football fields) between 2009 and 2050 in favour of other uses. Additionally, certain regions in the world are coming under pressure from increasingly unfavourable growing conditions and declining water availability which can impact their ability to continue to maintain historical crop production levels. All this can create scarcity value for existing high quality farmland.(1) When investing in farmland and agriculture, it is these macro trends that investors are getting exposure to.

Uncorrelated and Stable Returns

In Canada, farmland is predominantly owned by farmers, with investors estimated to hold less than 1% of farmland acreage.(2) As a result, values are driven by farmer-to-farmer transactions based primarily on farm profitability and largely uncorrelated to traditional asset classes or public markets.

Why is this? At a very high level, it’s because farmers are generally reluctant to sell their land, even during periods of low commodity prices, unless faced with significant financial challenges. Farming is an economies-of-scale business, and farm operators buy and sell land based on long-term business decisions rather than short-term financial speculation. Improved profitability through increased revenues (higher crop yields or planting higher value crops, etc.), or decreased expenses (reduced labour or input costs, etc.) all contribute to long-term value appreciation. These dynamics have contributed to Canadian farmland’s average annual rate of appreciation of approximately 7.5% between 1968-2023.(3)

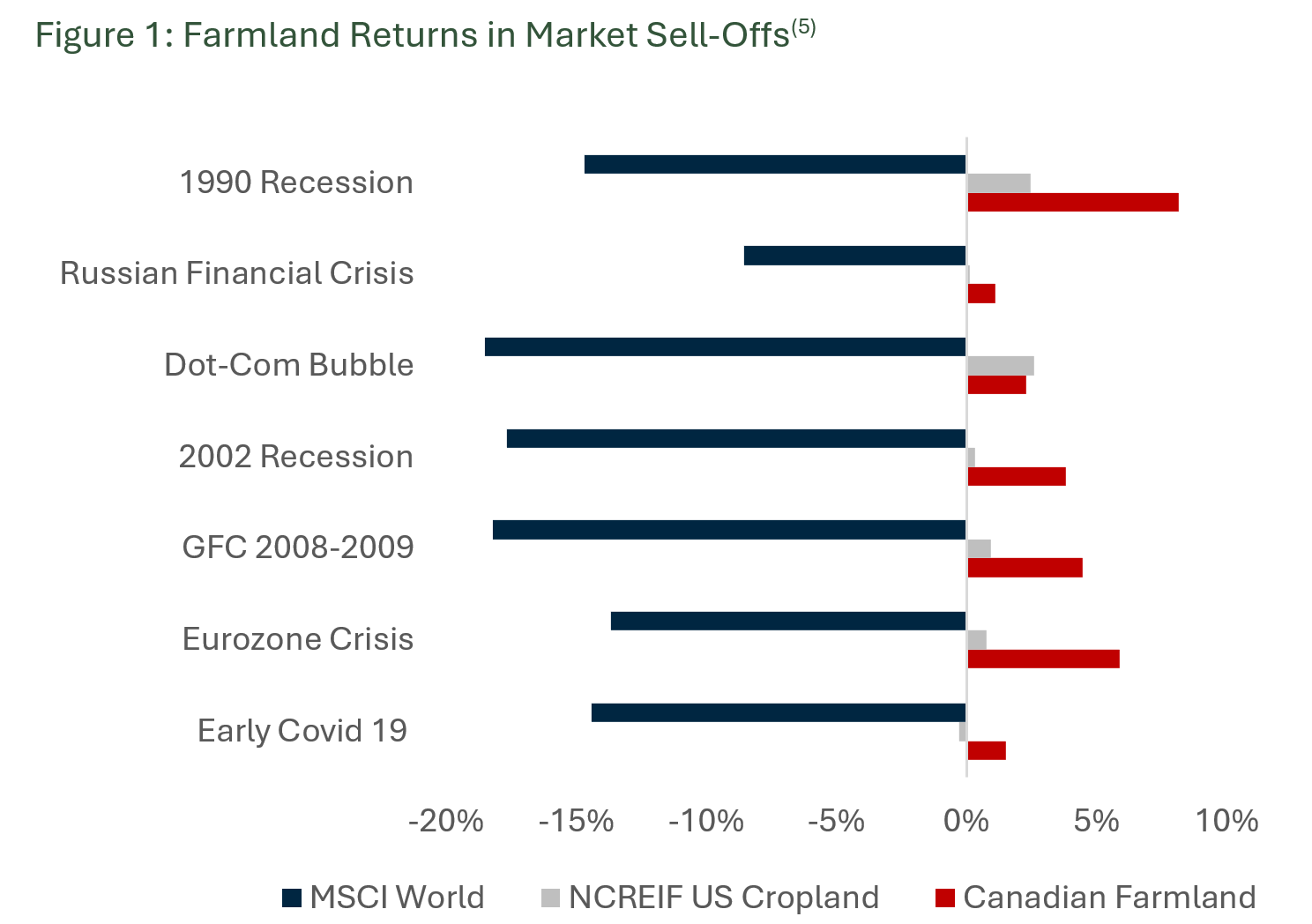

Bonnefield’s own farmland funds have generated a 10-year annualized return of 8.3% – similar to returns on Canadian equities over that period but with a third of the volatility.(4) From an investor perspective, the long-term value appreciation and stability of the asset class provide attractive risk-return trade-offs. The expected outperformance in times of market sell-downs also reduces the overall volatility of your investment portfolio and provides meaningful downside protection.

We expect heightened geopolitical risks over the coming years, under the Trump administration, with threats of tariffs and escalating trade wars resulting in increased volatility. This will likely result in market sell-downs for risk-on assets, as experienced in the first week of March 2025, We therefore believe that this environment makes investments in farmland appealing given the asset class’s ability to outperform in down markets and act as a powerful stabilizer within investment portfolios.

Inflation-Hedging Characteristics

Another sought-after feature of farmland investment is its outperformance against inflation. During inflationary periods, we experience increased food and commodity prices which generally result in increased farmer revenues. To illustrate, in 2021 and 2022, when Canadian CPI increased to 4.1% and 5.4%, Canadian farm cash receipts surged by 15.8% and 14.6%, respectively. In contrast, in 2020 and 2023, when inflation was lower at 1.5% and 2.6%, farm cash receipt growth was more modest at 8.2% and 4.6%.(6),(7)

With more money in their pockets, farmers are better positioned to reinvest in their operations – often by acquiring additional acreage. These periods of high inflation tend to see greater farmland transactions at higher values which then becomes the new baseline value for similar land in that region. In Canada, farmland values rose by 9.5% in 2021 and 14.6% in 2022, aligning with elevated inflation and despite cooling inflation in 2023 (CPI at 2.6%), they continued to increase at an annual rate of 15.5%, reflecting a lag effect as price benchmarks adjust to validated market transactions.(8),(9)

For investors, these dynamics create an opportunity to gain exposure to a resilient asset class that offers a safe haven for long-term wealth preservation during periods of economic uncertainty and inflation.

Climate and Farmland Returns

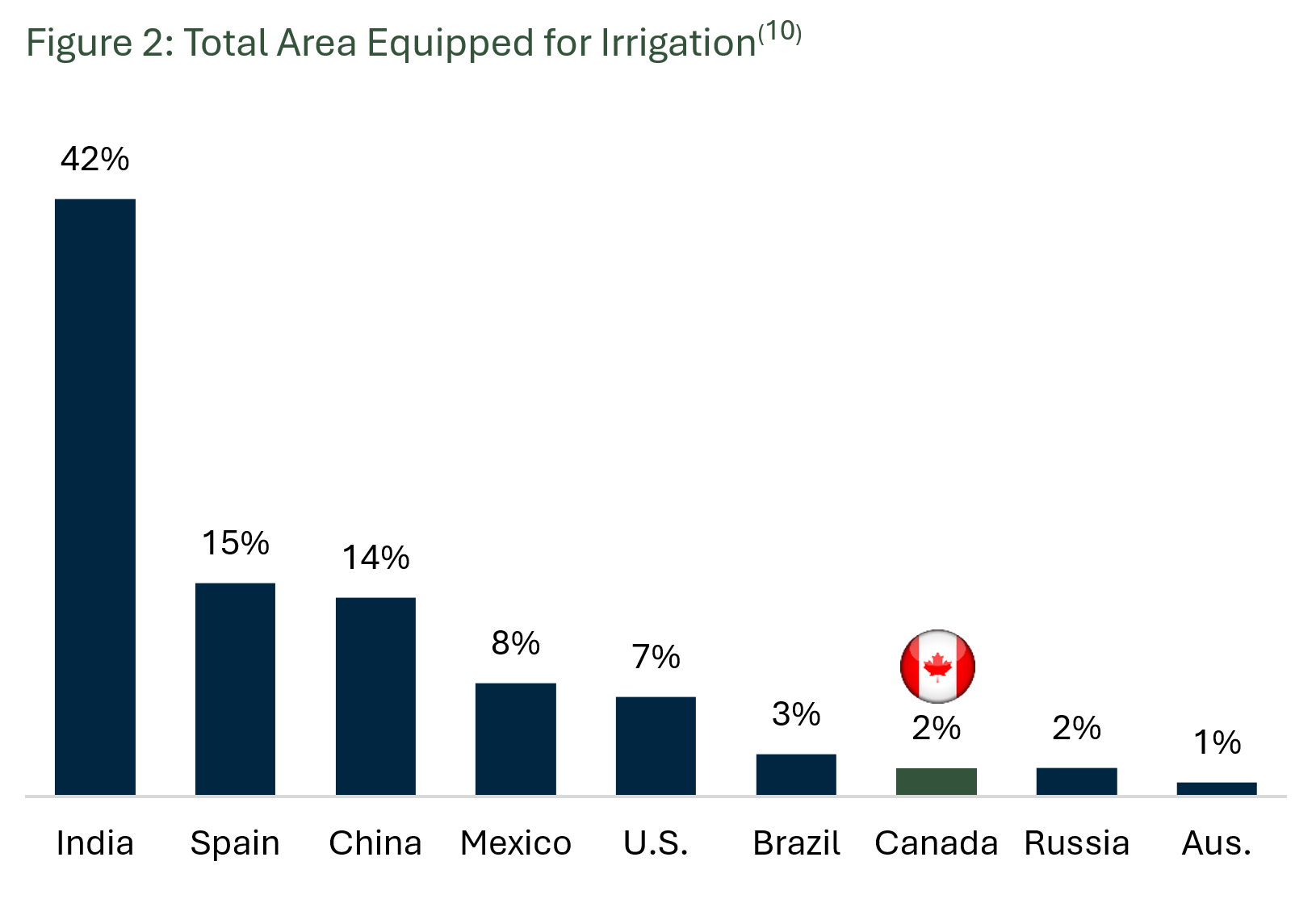

Adaptability has always been a defining trait of successful farmers, and today’s agricultural landscape is no exception. While climate change presents challenges—such as increased weather volatility—Canadian agriculture is uniquely positioned to benefit from key structural advantages. Longer growing seasons and increased heat units, along with advancements in crop genetics—such as drought-resistant seed varieties—are enabling diversification into higher-value crops. This expansion goes beyond the cold-weather staples historically associated with the region. Canada’s abundant freshwater resources and reliance on rainfed agriculture provide a significant hedge against the water scarcity risks affecting farmland in many other regions. These factors contribute to the long-term resilience of Canadian farmland, reinforcing its value as a stable, inflation-protected asset class with strong potential for appreciation.

Farmland – A Source of Stable, Long-Term Wealth Generation

As outlined above, farmland offers various attractive features. Its ability to diversify returns with low correlation to traditional public markets and other types of real estate reduces portfolio volatility. As a proven hedge against inflation, farmland can act as a long-term store of value, safeguarding wealth during uncertain economic times. Moreover, Canadian farmland specifically offers unique climate hedging characteristics due to its abundant access to fresh, renewable water sources, and changing growing conditions.

For these reasons, along with its critical role in meeting food production needs, we believe that Canadian farmland provides investors with a relative safe haven in uncertain times and is a great addition to an investment portfolio. It is no surprise that increasing numbers of individual investors are adding farmland to their holdings.

For information on the Bonnefield Farmland Funds, please reach out to investors@bonnefield.com

About Bonnefield Financial

Bonnefield is a leading Canadian farmland and agribusiness investment manager. We provide capital to progressive farmers and agribusiness operators through land-lease financing and non-controlling equity solutions. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers and agribusiness operators to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long-term sustainable future of Canadian agriculture.

Sources

1. FAO 2030-50 Projections of Arable Land (FAO (2017)); OurWorldInData.org/crop-yields.

2. Based on analysis conducted internally by Bonnefield in 2024.

3. Statistics Canada Value per acre of farm land and buildings at July 1, 2023. (table 32-10-0047-01).

4. Data to December 31, 2023 due to availability of returns at time of publication. Bonnefield figures based on a composite of our open-ended funds.

5. Source: Statistics Canada, Bank of Canada, MSCI, NCREIF Cropland. 1990 recession: Q1-Q4 1990; Russian Financial Crisis: Q3 1998; Dot-Com Bubble: Q2-Q1 2000-2001; 2002 recession: Q1-Q3 2002; GFC (Global Financial Crisis) 2008-2009: Q4 2007-Q1 2008; Eurozone Crisis: Q1-Q3 2009; Early Covid-19: Q1 2020.

6. Statistics Canada. Table 32-10-0045-01 Farm cash receipts, annual (x 1,000) DOI: https://doi.org/10.25318/3210004501-eng.

7. Statistics Canada. Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics – Bank of Canada definitions.

8. Statistics Canada. Table 32-10-0047-01 Value per acre of farm land and buildings at July 1.

9. Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics – Bank of Canada definitions – table 18-10-0256-01).

10. Food and Agriculture Organization of the United Nations – FAOSTAT Land Use Database (total agricultural land and total land area equipped for irrigation; data as of 2021).

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment. This communication is for informational purposes only and should not be relied upon for completeness. Any investment performance data outlined in this document should not be used to predict future returns. Any market prices, data, and third-party information are not warranted as to completeness or accuracy and are subject to change without notice. Prospective investors should take appropriate professional advice before making any investment decision. In all cases where historical performance is presented, note that past performance is not indicative of future results, and should not be relied upon as the basis for making an investment decision. There can be no assurance that any unrealized investments will ultimately be realized at the valuations taken into account in calculating the Funds performance presented herein, where applicable. The performance of such investments when ultimately realized may be materially different. This document may not be transmitted, reproduced, or used in whole or in part for any other purpose, nor may it be disclosed or made available, directly or indirectly, in whole or in part, to any other person without Bonnefield’s prior written consent.

Copying, distributing or sharing this document or its contents is expressly prohibited without the express, written consent of Bonnefield.