Download PDF

Canadian Agriculture: Assessing our Exposure to Potential U.S. Tariffs

In recent months, U.S. trade policy has taken center stage, with heightened rhetoric around tariffs and the potential for retaliatory actions from global trading partners. While no new U.S. tariffs have been implemented on Canadian agriculture, for investors in the space, the question still naturally arises: How vulnerable is the sector to these developments, and what are the implications for farmland investment?

At Bonnefield, we have been analyzing these questions closely. While there is no simple answer, understanding potential exposure, and the structural factors that can help mitigate it, is essential. Amid broader near-term macroeconomic and geopolitical uncertainty, we remain confident that Canadian farmland will once again prove to be a resilient, long-term store of value. In fact, tariff uncertainty further reinforces the case for investing in tangible, productive, and uncorrelated assets like high-quality Canadian farmland.

Key Factors That Will Determine The Impact of U.S. Tariffs

Although the full effects of potential future U.S. tariffs on Canadian agriculture are difficult to forecast, we generally expect some short-term downward pressures on commodity prices, and the actual impact will vary depending on the commodity and its reliance on the U.S. market. (We provide a more detailed analysis of key crops and export destinations later in this newsletter).

Several variables will influence the outcome:

- The ability of U.S. importers to absorb or pass on tariff-related costs

- Consumer response in the U.S. and the substitutability of Canadian products

- The extent to which Canadian consumers respond to U.S. tariffs with additional demand for Canadian products

- The scope and duration of the tariffs

- Canada’s potential retaliatory measures

- Broader global supply chain shifts prompted by U.S. protectionism

Ultimately, the global nature of agricultural commodity markets provides a natural buffer from potential tariff impacts as demand displaced by one market often finds a home in another. We saw this pattern emerge when India placed barriers on Canadian lentils in 2017, and when China restricted purchases of Canadian canola in 2019. In both these cases, Canadian production went elsewhere (largely to the EU) to supply crop shortages created by China and India’s changing trade patterns.

Mitigating Forces Supporting The Sector

Several macroeconomic and sector-specific dynamics are poised to help offset the potential downside:

1. Lower Interest Rates

In a recessionary environment, interest rates are likely to remain low or even decline, helping to alleviate some of the financial pressures faced by Canadian farmers.

2. Favourable Currency Dynamics

A weaker Canadian dollar provides a natural hedge for producers, as most agricultural commodities are priced in U.S. dollars. This supports Canadian export competitiveness and farmer profitability, even amidst tariff disruptions.

3. Government Support

Historically, the Canadian government has acted to support the agriculture sector during times of stress. For example, during the 2018–2019 trade dispute with China, the Canadian government provided $150 million in insurance support to canola exporters and expanded the Advance Payments Program, offering up to $1 million in loans – half of which was interest-free for canola producers.(1),(2) We would expect policy intervention if tariffs were to cause sustained disruption.

4. Export Market Diversification

The global nature of agriculture means that if one region imposes trade restrictions, others often increase their purchasing to fill the gap. Canada’s growing network of trade agreements supports this flexibility.

5. Low Agricultural Stockpile

Demand from a growing worldwide population, combined with years of geopolitical and climate change induced production challenges, have resulted in declining global stocks-to-use ratios for most agricultural commodities, e.g., corn stock-to-use ratio is currently at a 10-year low.(3) Consumers around the world will need Canadian crops, regardless of US tariffs and trade disruptions.

U.S. and Canadian Agricultural Trade Flows Have Changed in Recent Years

Most Canadians are surprised to learn that in the last decade, Canada has gone from being a net importer of food from the U.S. to a net exporter.(4) This is true of bulk agricultural commodities (like grains) as well as for intermediate goods (like livestock and feed) and even for branded consumer food products. On the face of it, being a net exporter to the U.S. would suggest that Canada is more vulnerable to U.S. agricultural tariffs than when we were a net importer. However, it is also true that U.S. food manufacturers and end consumers are much more reliant on Canadian crops than they were even a decade ago. A February 2025 policy note from Agrifood Economic Systems concluded:

“…on a net basis, Canada is feeding the U.S.. Tariffs that increase the price of agri-food products imported by the U.S. from Canada will cost U.S. consumers. If tariffs are sufficient to effectively halt Canada-U.S. trade in some products, the U.S. will be shorted in these products to some degree, for some period of time, and prices could increase sharply.” (5)

On balance, U.S. reliance on Canadian farmers suggests that agricultural tariffs are likely to have a big impact on U.S. producers and consumers and are, therefore, likely to be short lived if implemented.

The China Factor

While the focus of much attention is on U.S. tariff policy, Chinese tariffs (both on the U.S. and on Canada) are also important to consider. China’s recent imposition of a 100% tariff on Canadian canola oil and meal, along with a 25% tariff on seafood and pork, marks a significant escalation in the ongoing trade tensions between the two nations. These measures, effective from March 20, 2025, were introduced in direct response to Canada’s earlier decision to levy a 100% tariff on Chinese electric vehicles and a 25% tariff on steel and aluminum imports – actions that Canada justified as necessary to counteract unfair subsidies and market distortions by China.

As noted earlier in this newsletter, China has taken similar steps in the past, most notably in 2019, when it suspended import permits for major Canadian canola exporters. Although this move initially disrupted Canadian canola exports, the industry demonstrated resilience by diversifying its markets and finding alternative buyers. That episode, like the current one, initially disrupted trade and put downward pressure on farm margins and cash receipts. But Canadian producers quickly adapted: displaced volumes found new homes, largely in the EU, where supply gaps created by shifting global trade patterns provided new market opportunities. The current situation is likely to follow a similar trajectory. We also note that China’s current tariffs target canola oil and meal, which are considered processed forms of canola. Most of China’s canola imports from Canada consist of unprocessed canola, such as seeds, (e.g. in 2024, ~80% of canola exported to China was unprocessed) and therefore, the overall impact of these tariffs is relatively limited.(6)

These recurring patterns speak to the resilience of Canadian agriculture and the buffering effect of globally integrated commodity markets. While near-term volatility in prices and cash flows is expected, past experience suggests that Canada’s export-oriented producers are well positioned to weather this period of uncertainty. Diversification of markets and continued investment in trade infrastructure will remain key to mitigating future shocks and maintaining long-term sector stability.

These dynamics are not unique to Canada. Recent Chinese tariffs on U.S. agricultural products, including soybeans and corn, have similarly demonstrated that in a globally undersupplied market, protectionist measures often result in a rerouting of trade rather than a net reduction in supply. As China reduces its reliance on U.S. commodities, countries like Brazil and Argentina have stepped in to meet demand. China’s share of soybean imports from the U.S. fell from 40% in 2016 to 18% in 2024, while Brazil’s share rose from 46% to 74% during the same period. Brazil has also surpassed the U.S. as China’s top corn supplier since gaining market access in 2022.(7) These shifts underscore the adaptability of global supply chains and the limitations of tariffs as a tool for influencing long-term trade dynamics. For Canadian producers, this reinforces the importance of maintaining access to diversified markets and investing in the agility needed to respond to changing global conditions.

Diversification of Canada’s Export Markets is Well Underway

Canada has actively expanded its agricultural trade relationships beyond the U.S. through landmark agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Comprehensive Economic and Trade Agreement (CETA) with the EU. These agreements have unlocked access to new, high-growth markets for Canadian crops, strengthening the sector’s global competitiveness and reducing risks related to overreliance on any single jurisdiction.

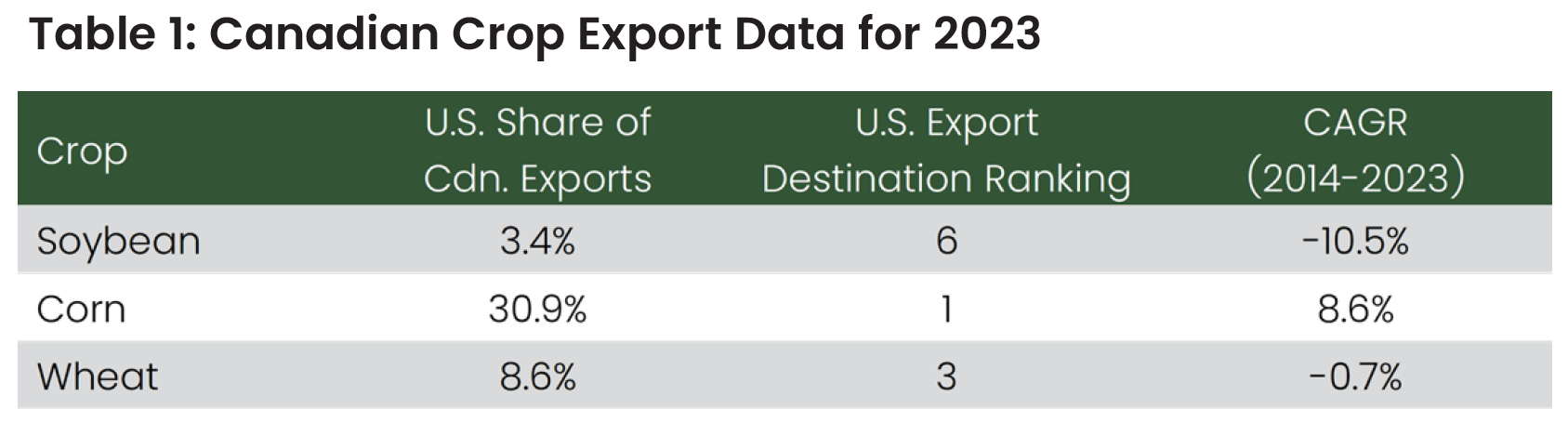

Bonnefield recently undertook a review of its farmland portfolios to evaluate likely exposure to the U.S. market. Three of the largest exposures in our portfolios are soybeans, corn, and wheat, which are also the major crops exported by Canada. The table below outlines the U.S.’ share of Canadian exports for each key crop in 2023, its ranking as a key export destination, and the associated compound annual growth rate (CAGR) from 2014-2023, based on total dollar value exported in CAD for each of these crops.(8)

The takeaway from this data should give Canadian farmland investors comfort.

- Soybeans: The U.S. share of Canadian soybean exports has steadily declined, with growing demand from Asia and the Middle East driving future growth.

- Wheat: Similarly, wheat exports have shifted away from the U.S., also favouring Asian and Middle Eastern markets.

- Corn: While the U.S. saw a spike in corn imports from Canada in 2023, European markets, particularly Ireland, Spain, and the U.K., have been rapidly gaining ground, with impressive CAGRs of 19.2%, 8.7%, and 27.2%, respectively. In fact, these three countries represented over 60% of Canadian corn exports in 2023.(9)

This diversification highlights the growing resilience of Canada’s export ecosystem and its ability to adapt to evolving global trade dynamics, specifically in times of trade embargoes and tariffs from certain jurisdictions. Internally, Bonnefield continues to prioritize business development in regions with diverse crop capabilities and export access.

Long-Term Outlook: Still a Strong Case for Investment

Despite near-term trade uncertainty, we believe Canadian agriculture remains fundamentally strong. Canadian farmland continues to offer a compelling investment thesis grounded in:

- Stable, uncorrelated returns

- Limited volatility relative to other asset classes

- Long-term supply/demand imbalances in global food and energy markets

Tariffs may bring temporary volatility, but they do not alter the long-term drivers of farmland value: population growth, dietary shifts, and the transition toward renewable energy sources.

Importantly, periods of market disruption often create attractive entry points. In a sector that has historically suffered from underinvestment, the current environment presents an opportunity to deploy capital in ways that enhance productivity, support farmers, and drive long-term value creation.

In Summary

Canadian agriculture remains fundamentally sound and increasingly diversified. Bonnefield’s portfolio strategy, rooted in high-quality farmland with broad market access, is well positioned to navigate volatility and capitalize on opportunity even in the face of potential U.S. tariffs.

About Bonnefield Financial

Bonnefield is a leading Canadian farmland and agribusiness investment manager. We provide capital to progressive farmers and agribusiness operators through land-lease financing and non-controlling equity solutions. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers and agribusiness operators to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long-term sustainable future of Canadian agriculture.

Sources

1. Government of Canada, “Canada backs Canadian canola farmers and exporters with $150 million in insurance support,” June 13, 2019.

2. Government of Canada, “Government of Canada implements new regulations to enhance Advance Payments Program,” June 3, 2019.

3. MacroMicro, “World – Corn Stocks-to-Use Ratio” as of April 2025.

4. Government of Canada, “The United States’ trade with Canada and Canada’s trade with the United States,” February, 2024.

5. Al Mussell, Douglas Hedley, and Ted Bilyea, Canadian Agri-Food is Highly Vulnerable to US Tariffs. The US Should Worry Too, Agri-Food Economic Systems, February 2025.

6. Canola Council of Canada: Profiles of Canada’s leading canola markets. August 2024.

7. Reuters, “Chinese buyers switch to cheaper Brazilian soybeans ahead of Trump return,” January 17, 2025.

8. Government of Canada: Trade Data Online.

9. Government of Canada: Trade Data Online.

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment. This communication is for informational purposes only and should not be relied upon for completeness. Any investment performance data outlined in this document should not be used to predict future returns. Any market prices, data, and third-party information are not warranted as to completeness or accuracy and are subject to change without notice. Prospective investors should take appropriate professional advice before making any investment decision. In all cases where historical performance is presented, note that past performance is not indicative of future results, and should not be relied upon as the basis for making an investment decision. There can be no assurance that any unrealized investments will ultimately be realized at the valuations taken into account in calculating the Funds performance presented herein, where applicable. The performance of such investments when ultimately realized may be materially different. This document may not be transmitted, reproduced, or used in whole or in part for any other purpose, nor may it be disclosed or made available, directly or indirectly, in whole or in part, to any other person without Bonnefield’s prior written consent.

Copying, distributing or sharing this document or its contents is expressly prohibited without the express, written consent of Bonnefield.