Q3 2024 – Is Now the Time to Invest in Canadian Farmland?

Download PDF

Is Now the Time to Invest in Canadian Farmland?

Introduction

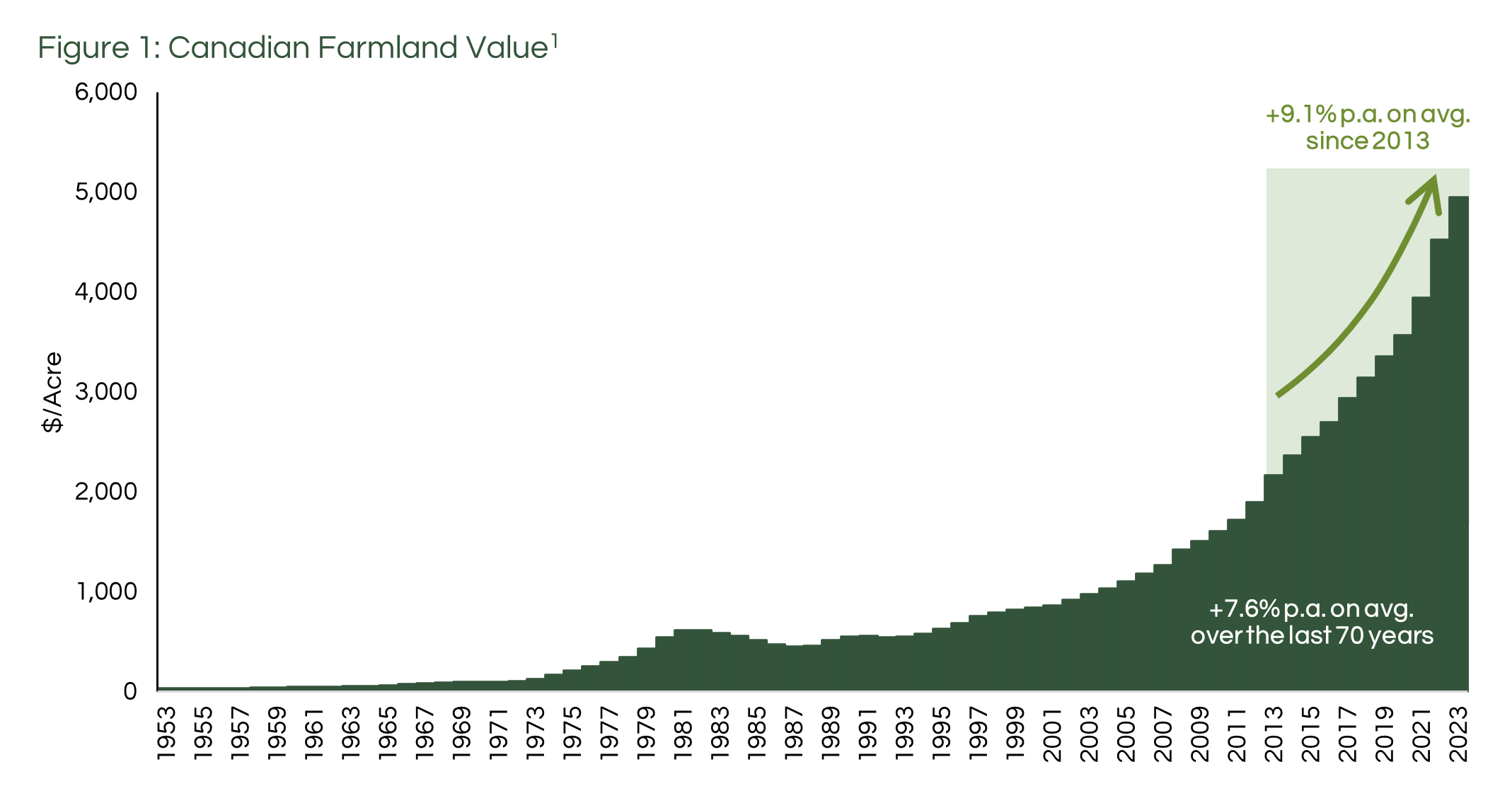

Record-high stock markets, geopolitical crises, US political uncertainty, potential rebound in inflation, currency volatility, interest rate uncertainty… we live in “interesting” times. All this uncertainty has led to an increasing number of investors looking to alternative assets to complement and hedge their investment portfolios. Historically, one of the more attractive assets in times of uncertainty is Canadian farmland. The asset class offers low volatility and has a track record of average annual returns of 7.6%(1) over the last 70 years, without meaningful periods of declining value. More recent data shows Canadian farmland prices have increased by an average of 9.1% on average annually over the last decade.(1) But after several years of strong farmland returns, is now still a good time to invest in Canadian farmland, or are we at a “peak”?

Let’s look at some historic data to see if today’s “timing” is good, bad or indifferent to expected farmland returns.

“Timing the Market” Not a Relevant Concern for Farmland

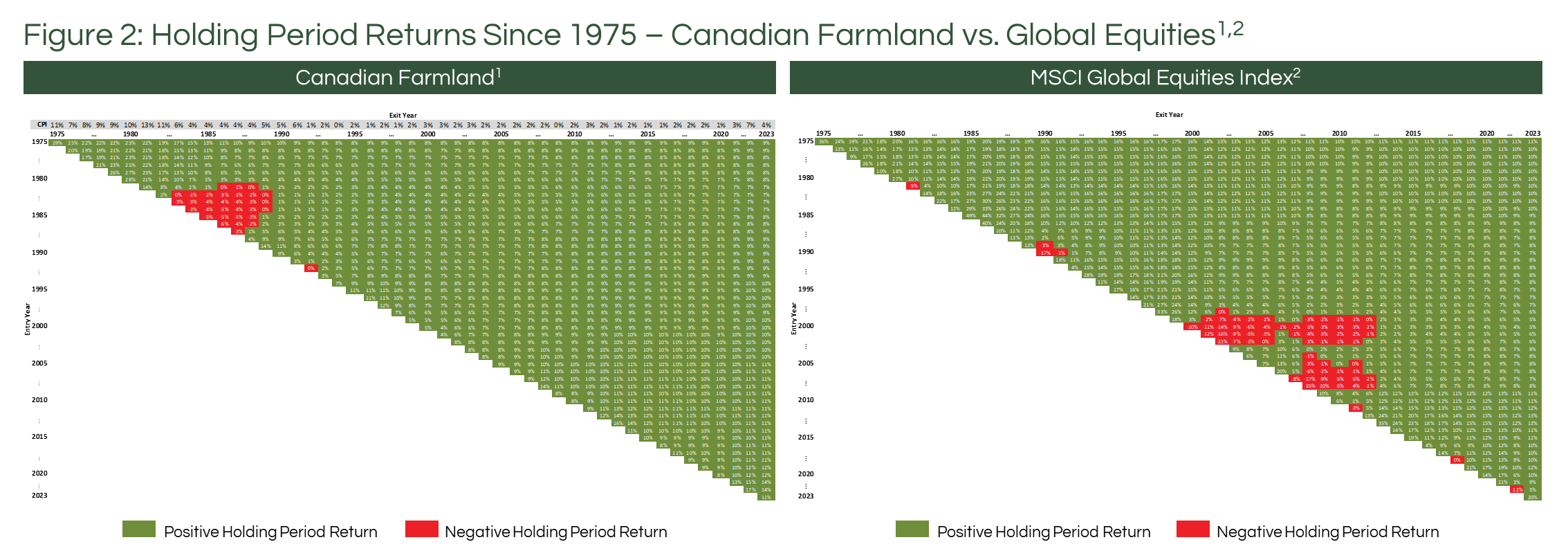

Determining the right time to invest is typical in stock and bond markets, as no one wants to enter at the top of the market. The situation is different for a low-volatility and uncorrelated asset like Canadian farmland. To illustrate the point, imagine you had invested in Canadian farmland each year from 1975 to 2023. You would have had positive returns on each of those investments, with only eight entry years showing negative returns.(1)(2) In contrast, global equities saw negative returns for 17 of the entry years during the same period.(3) This result is unsurprising for fans of farmland investing who are attracted to its low volatility and uncorrelated returns. We have included in Figure 2 below a summary of the historical holding period returns for both asset classes.

What may be surprising even to long-time farmland investors, however, is that investing in Canadian farmland immediately following a year of heightened value appreciation (10% or above) still resulted in strong, long-term returns in line with historical averages. The data suggest that, rather than waiting for a “dip” in the market to invest in farmland, having exposure to the asset and benefitting from its long-term correlation to inflation should support positive investment returns with limited volatility.

Can the Trend Continue?

As seen in the figure above, farmland prices have historically increased at a steady rate. The typical pattern for this asset class is a period of strong growth, generally linked with commodity super cycles, followed by more muted growth. Very rarely have there been absolute decreases in land values, and only temporary ones. This long-term growth history can lead some to question whether ongoing value growth is sustainable. At Bonnefield, we believe that it is, and that there remains significant upside in farmland values.

As a scarce resource, high-quality farmland in regions supported by positive long-term climate and water conditions will increasingly be in demand. Farmland is the base upon which we will continue to meet increasing crop production requirements to satisfy food and alternative energy demands and understanding this, along with the drivers of farmland value (e.g., farm revenues and productivity growth, farmland consolidation, etc.), helps to understand why we believe that farmland provides strong, long-term value appreciation potential.

Now is a Great Time to Invest in Canadian Farmland

Bonnefield expects to continue to see growth in Canadian farmland values supported by farm revenue and productivity growth. Along with the limited price volatility of the asset class, we believe that investing in Canadian farmland offers attractive risk-adjusted returns and that investors can benefit from earlier exposure to the asset class rather than waiting for “the right time” to enter the market.

About Bonnefield Financial

Bonnefield is a leading Canadian farmland and agribusiness investment manager. We provide capital to progressive farmers and agribusiness operators through land-lease financing and non-controlling equity solutions. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers and agribusiness operators to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long-term sustainable future of Canadian agriculture.

Sources

1. Statistics Canada. Table 32-10-0047-01 Value per Acre of Farm Land and Buildings at July 1, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3210004701.

2. Holding period returns calculated by varying investment entry and exit years and adding a 2% cash yield (mid-point of the cash yield target of Bonnefield’s farmland strategy). Capital appreciation is assumed to be identical to Statistics Canada’s farmland values dataset as at July 1st of each year.

3. MSCI World Index total return, large and Mid cap, reported in CAD, https://www.msci.com/end-of-day-data-search.

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment. This communication is for informational purposes only and should not be relied upon for completeness. Any investment performance data outlined in this document should not be used to predict future returns. Any market prices, data, and third-party information are not warranted as to completeness or accuracy and are subject to change without notice. Prospective investors should take appropriate professional advice before making any investment decision. In all cases where historical performance is presented, note that past performance is not indicative of future results, and should not be relied upon as the basis for making an investment decision. There can be no assurance that any unrealized investments will ultimately be realized at the valuations taken into account in calculating the Funds performance presented herein, where applicable. The performance of such investments when ultimately realized may be materially different. This document may not be transmitted, reproduced, or used in whole or in part for any other purpose, nor may it be disclosed or made available, directly or indirectly, in whole or in part, to any other person without Bonnefield’s prior written consent.

Copying, distributing or sharing this document or its contents is expressly prohibited without the express, written consent of Bonnefield.