Download PDF

Canadian Farmland Poised For Growth

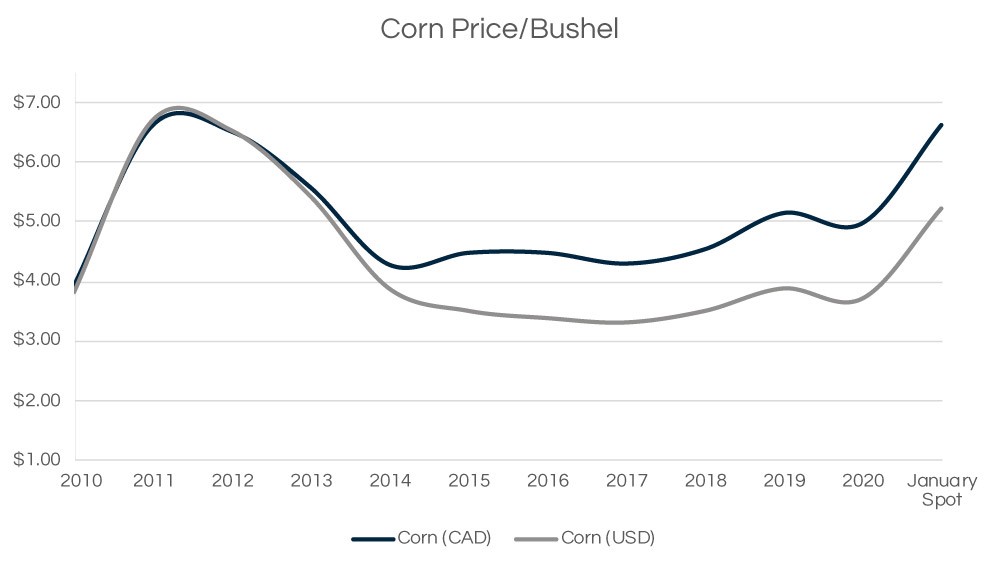

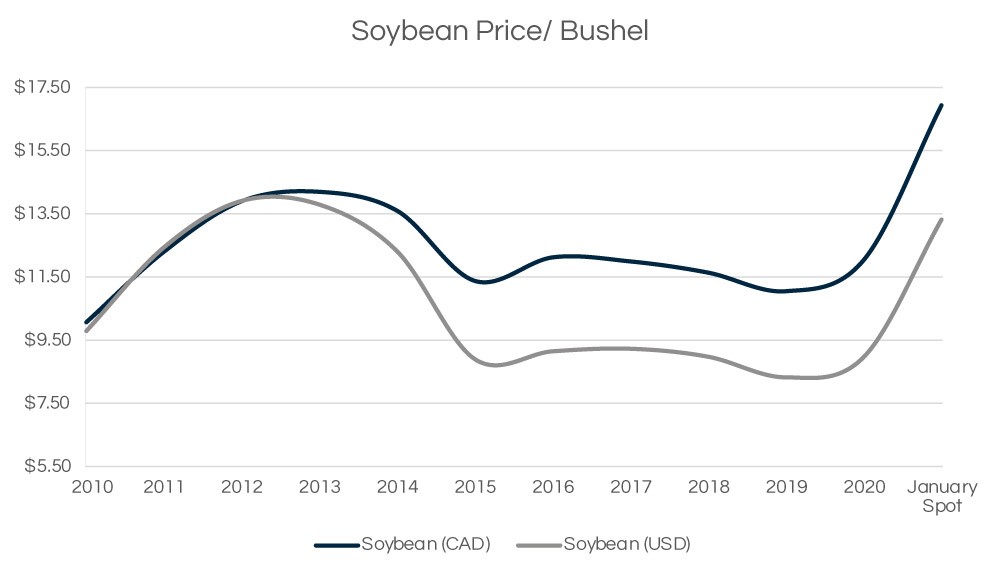

The mood in much of the Canadian agricultural community has been positive lately. Following several years of depressed agricultural commodity prices, there is a significant rebound in prices across multiple commodities. The last time we saw similar commodity price growth, combined with low interest rates was in 2011 which marked the beginning of several years of double digit increases in farmland values. While there is no guarantee that we will have the same outcome, the signs are very encouraging.

1. Increased Demand from China

The catalyst for this rebound has been a massive increase from China for feed, as it rebuilds its hog herds following the devastating impacts of the 2018 swine flu that resulted in a ~60% reduction of the country’s breeding sows by the second half of 2019 (1). We expect that the increase in demand from China should be longer lasting as it will likely take two to three years to rebuild the pig herds back to pre swine flu levels.

2. Severe Drought in South America

A severe drought in South America since last October drastically reduced supply from Brazil and Argentina – two major corn and soybean producers. While this offers short-term support to pricing, recent rains in the region should provide positive conditions for the current harvest.

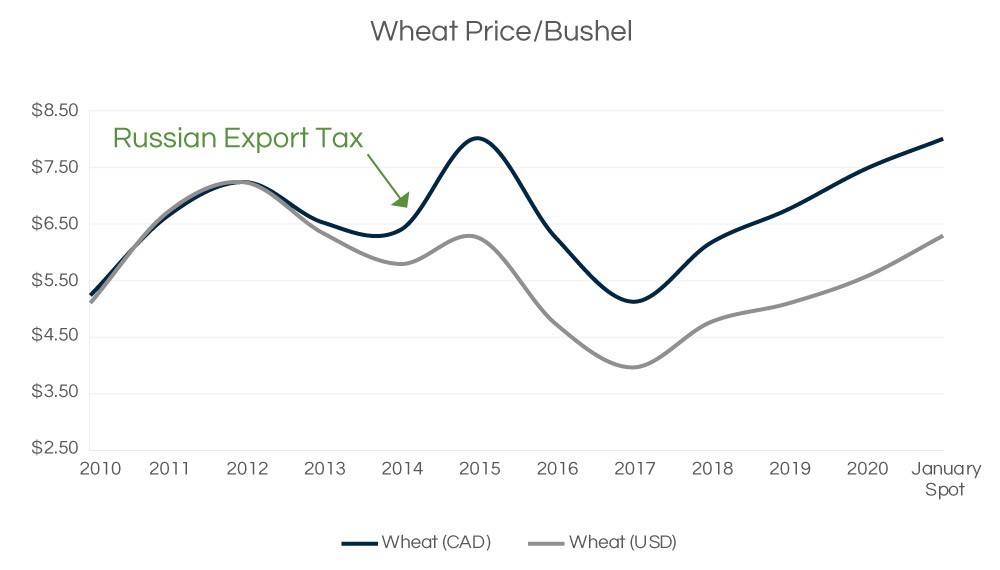

3. Russian Export Tax on Wheat

Finally, prices are also seeing an impact from a recently announced export tax that Russia placed on its wheat producers in an attempt to reign in recent domestic food price inflation resulting from COVID-19. In 2015, this had a major impact on global wheat supply. We expect a similar impact this year with wheat prices increasing materially.

Sources: OMAFRA, Grain Farmers of Ontario

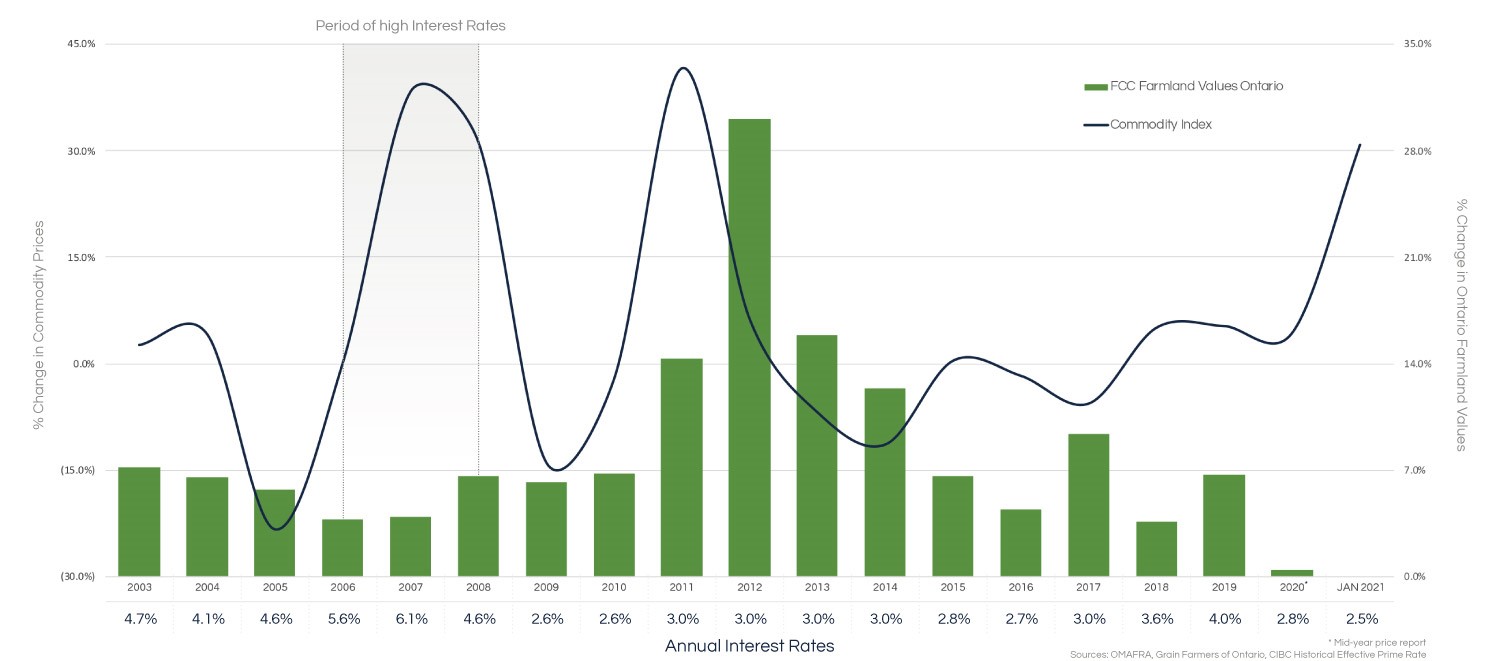

Commodity Price Impact on Farmland Values

Given the magnitude of recent commodity price increases we took a look back to see what effect commodity prices have had on farmland values historically. Two notable characteristics emerge from this analysis.

1. Significant upside potential for farmland values resulting from a combination of high commodity prices and low borrowing costs.

This creates a favourable environment whereby farm profitability increases, leaving farm operators with more cash in their pockets. The combination of greater cash on hand and low borrowing costs facilitates an increase in farmland acquisitions. Having this combination of factors is important because, as we saw in 2007, an increase in commodity prices against the backdrop of high borrowing costs, did not see meaningful farmland value increases.

2. Farmland values have had historical downside protection through several years of significant commodity price decreases.

Not only have farmland values failed to track the declines in commodity pricing, they have actually continued to increase in value (albeit at a slower rate in years of significant commodity price declines.) This trend can be attributed to the favourable supply and demand dynamics that exist due to a limited supply of global arable farmland with an increasing demand for food. From 1961 to 2016 there was a 48% decline in hectares of arable land per person (2). This is attributable both to a growing population as well as a decline in total arable land from desertification and urbanization.

It is evident, based on historical analysis, that commodity prices can influence farmland values through enhanced farm profitability. Based on our experience of the last two decades, that influence is far more significant on the upside than it is on the downside.

What This Means For Farmland Values

While there is always potential for unforeseen events to arise, a review of current market conditions provides support for a positive outlook on farm prices. The combination of increasing commodity prices and low borrowing costs shows the potential for a return to farmland valuations reminiscent of the early 2010’s.

A Note on the Analysis

We focused our analysis on Ontario using the three main cash crops grown in the province: wheat, soybeans, and corn. According to data from the Ontario Ministry of Agriculture, Food and Rural Affairs (“OMAFRA”), these three crops represent roughly 71% of the total cropland in Ontario based on seeded acres which makes this a meaningful, albeit simplifying, analysis for evaluating general trends in the province. In addition to commodity prices, we have also included the prime rate as a proxy for farmers’ borrowing costs, as this also has a significant influence on land values. The graph above illustrates the annual percentage change in commodity prices and Ontario farmland values against the prime rate. To capture historical commodity prices, we used a hypothetical commodity price index comprised of 40% soybeans, 40% corn and 20% wheat. This is representative of a typical five-year rotation for an Ontario farmer of two years planted to corn, two years planted to soybeans and one year to wheat.

About Bonnefield Financial

Bonnefield is the foremost provider of land-lease financing for farmers in Canada. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers to provide farmland leasing solutions to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long term future of Canadian agriculture. www.bonnefield.com

Contributing Authors:

Jaime Gentles

Director, Investment Management

Jeff McAllister

Vice President Investments

Andrea Gruza

Vice President Capital Markets

(1) – www.reuters.com/article/china-swinefever-pigs-idUSL4N2FC2RL

(2) – World bank. https://data.worldbank.org/indicator/AG.LND.ARBL.HA.PC