Download PDF

Canadian Farmland & Inflation

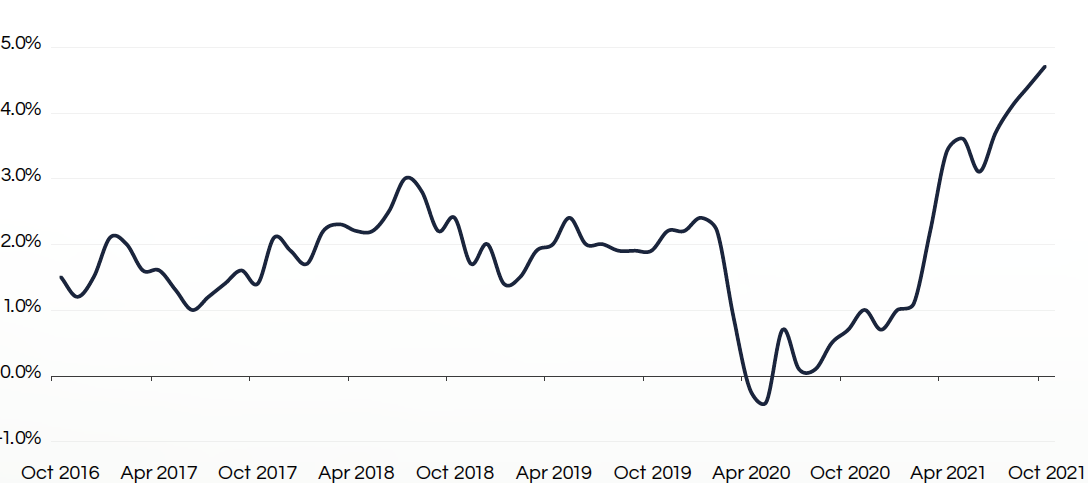

It is impossible to read the news these days without seeing inflation-related headlines. Canadian inflation rates have generally been low and stable in recent years. However, recent data puts inflation at the forefront of investors’ minds. As countries around the world begin to emerge from the wide-scale restrictions and shutdowns implemented in early 2020 as a result of the COVID-19 pandemic, inflation numbers have steadily crept up with the latest year-over-year Canadian Consumer Price Index (CPI, all items including gasoline; a key inflation measure) coming in at 4.7% for October 2021 – the highest rate since 2003(1).

This is certainly notable, as the Bank of Canada typically targets inflation of 2% over the medium term with its target range being 1-3%(2). In recent years, inflation has hovered at the low end of that range.

Canadian Consumer Price Index (CPI), Monthly 12-Month Percentage Change Data (2016-2021)

Source: Statistics Canada, October 2021

As inflation creeps up, many investors ask what can be done to preserve the long-term value of their assets. Gold is often cited as an asset which provides inflation-hedging characteristics but farmland is increasingly being recognized as having similar characteristics while experiencing less volatility and historical downside protection(3).

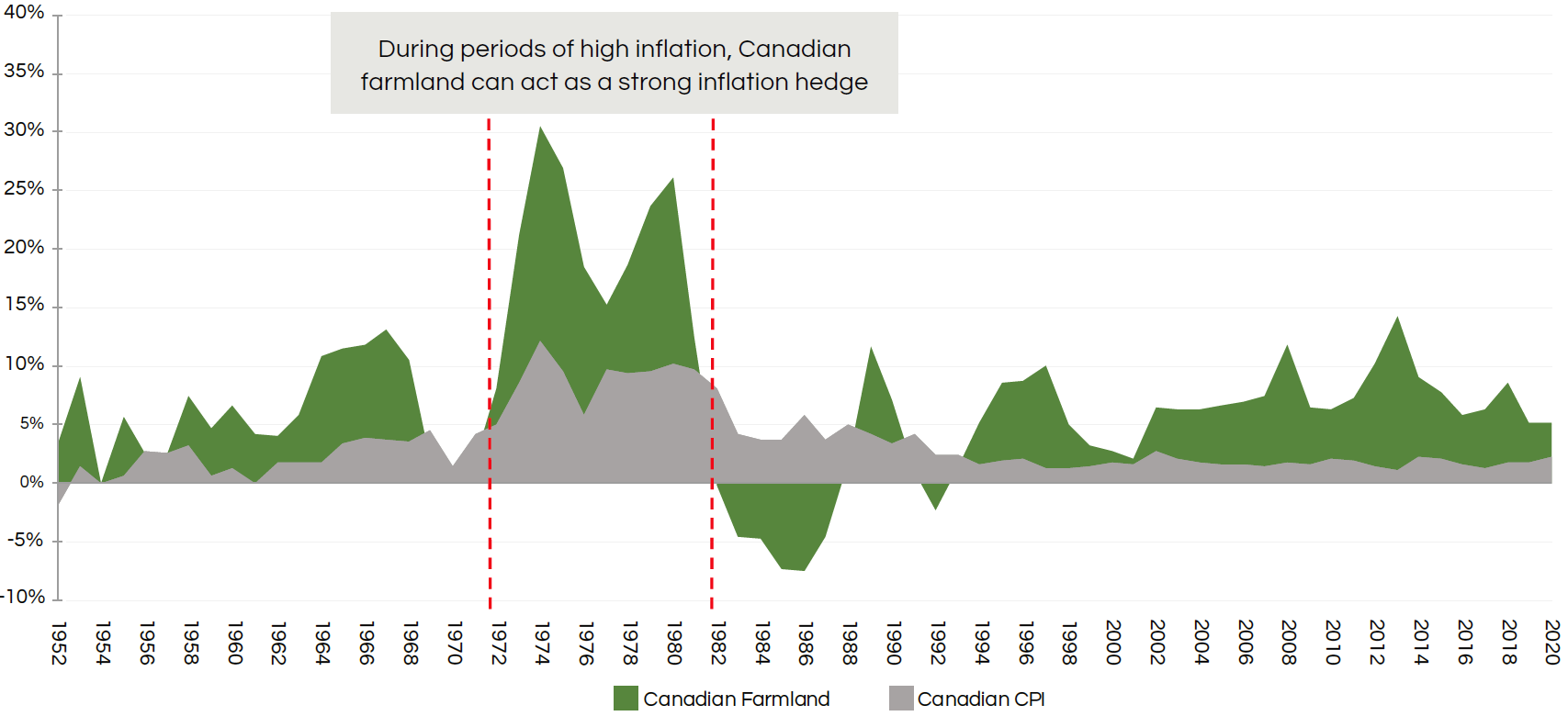

Canadian Farmland as an Inflation Hedge

Canadian farmland values have historically demonstrated a strong positive correlation to inflation, as measured by the Canadian Consumer Price Index (CPI), with the relationship being particularly notable in years of high inflation. Between 1952 and 2020, when Canadian CPI rose between 1% and 3% year-over-year, the average year-over-year change in Canadian farmland values was approximately 7%. However, when Canadian CPI increased 5% or more, the average change in Canadian farmland values year-over-year was significantly higher at approximately 16%(4).

This relationship between inflation and farmland values can largely be explained by increasing commodity prices and the dynamic created by increasing global demand for food, driven by continued global population growth and an inherently limited supply of arable land. Simply put, commodity inflation generally increases farm incomes, and as farm incomes increase, so too do farmland values.

We note that in the late 1980s, farmland prices did not increase in line with inflation due to some unique features of the time period. Total absolute debt levels in the Canadian agricultural sector increased at a compound annual growth rate of approximately 15% between 1973 and 1981(5) as farmers took on debt to fund real estate purchases as land values continued to rise. Then, between the late 1970s and early 1980s, we saw rapidly increasing, high interest rates to control inflation, with the Bank Rate reaching as high as 21% in August 1981 (compared to approximately 10% in August 1980)(6). The high interest rates of the early 1980s affected farmland values by decreasing the affordability of traditional loans, including agricultural financing which resulted in a wave of farmers (particularly in Western Canada) entering into insolvency.

The unique confluence of factors that led to a compression of farmland values in the mid- to late 1980s has not recurred since. While there has been some fluctuation, total Canadian farm sector debt levels have generally grown at much more modest levels from the early 1990s onward(7), and interest rates have remained at historic low levels for over a decade.

Historical Canadian CPI and Canadian Farmland Values (1952-2020)

Source: Statistics Canada.

Note: Data represents annual changes from December 1952 – December 2020 in Canadian farmland values and annual change in Canadian CPI. Farmland year over year return data represents land values only.

The current environment seems to be playing out differently compared to the 1980s, with guidance from most central banks remaining accommodative. In its most recent Monetary Policy Report, the Bank of Canada indicated that it expects CPI inflation to ease in 2022 as pandemic-related disruptions to supply gradually begin to fade[7], and appears to be committed to maintaining the policy rate at the lower end to continue stimulating the economy(8).

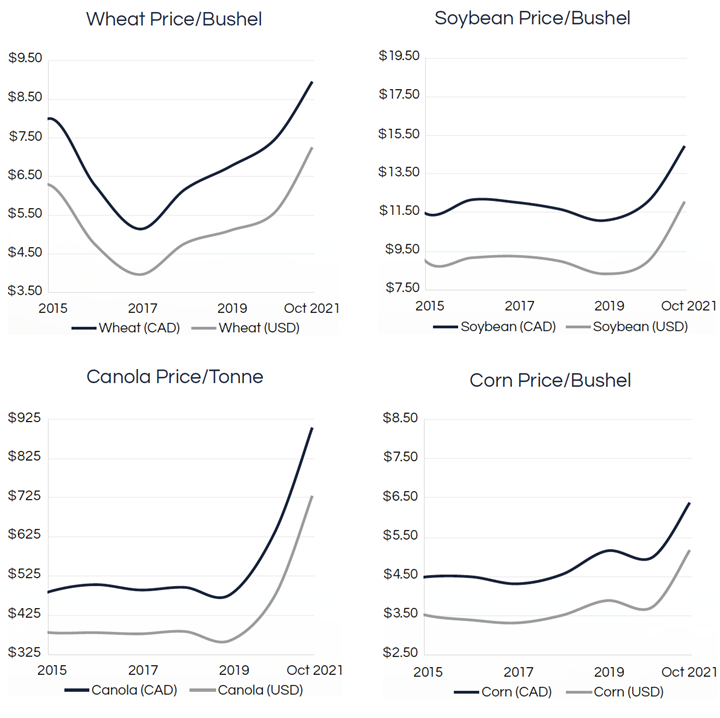

Finally, we anticipate continued strength in market prices for Canada’s key agricultural commodities (wheat, soy, canola, and corn).

Key Agricultural Commodity Prices (2015-2021)

Source: Bank of Canada, Bloomberg News, Grain Farmers of Ontario, ICE Data, OMAFRA.

Strong market prices for these commodities, like the multi-year highs observed in 2021, can translate directly into increased farm incomes that leave farm operators with more cash on-hand and contribute to strong activity in the Canadian farmland market.

Recent Trends in Farmland Values

Farmland is a long-term asset class with limited transaction windows as farmers typically do not buy or sell farmland between seeding in the spring and harvest in late fall. As such, we typically expect values to lag broad market conditions and do not look to quarterly updates as fully reflective of future performance. With that said, as an active farmland owner across Canada, Bonnefield is seeing high and increasing demand for land in some premium farmland regions, supporting strong farmland values.

Farm Credit Canada (FCC) reported in late September 2021 that, despite drought conditions that affected Western Canada during the summer months and a relatively slow overall economic recovery from the COVID-19 pandemic, strength in key commodity prices and the prolonged low interest rate environment continued to support both strong demand and increased prices for Canadian farmland. FCC reported an average year-over-year increase in Canadian farmland values across all provinces of 6.1% as of July 2021, with a notable 15.4% year-over-year increase in farmland values in Ontario, which is home to many of the country’s prime farming regions(9).

Bonnefield’s internal analysis based on third-party appraisals of our properties as well as interactions with industry stakeholders support the themes highlighted in the FCC report. In Western Canada, appraisers noted property value increases of 3-10% in Manitoba, 5-10% in Saskatchewan, and 3-6% for irrigated farmland in Alberta, year-to-date in 2021. In Eastern Canada, we have seen increases in appraised values of between 2-5% in the Maritimes and Northern, Central, and Eastern Ontario. Like data from FCC, our own experience supports the view that high demand among farm operators for land in Southwestern Ontario is resulting in increases to farmland values of upwards of 10%. We note that the overwhelming majority of transactions that we see in the Canadian market occur farmer-to-farmer with prices reflecting farm operator sentiments for future farm incomes and land value appreciation.

Unlike gold, Canadian farmland values appear to be driven by real returns that drive farm profitability. This supports farmland’s role as an attractive asset class for investors looking to benefit from positive long-term value appreciation that outpaces inflation.

About Bonnefield Financial

Bonnefield is the foremost provider of land-lease financing for farmers in Canada. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers to provide farmland leasing solutions to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long term future of Canadian agriculture. www.bonnefield.com

Contributing Authors:

Bhushan Chiniah

Director, Portfolio Management

Lauren Michell

Director, Capital Markets

Sources:

(1) Statistics Canada, November 2021

(2) Bank of Canada

(3) The Conversation, March 2021

(4) Statistics Canada, May 2021 & October 2021

(5) Statistics Canada, October 2021

(6) Statistics Canada, October 2021

(7) Bank of Canada, October 2021

(8) Bank of Canada, September 2021

(9) Farm Credit Canada, July 2021

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment.