Download PDF

Permanent Crops and Canada’s Evolving Agricultural Landscape

As a major agricultural producer and exporter, Canada is a leading supplier of traditional cold-weather crops such as wheat and canola across the globe. However, higher-value permanent crops such as apples, berries and stone fruits are increasingly being grown in Canada as growing conditions continue to become more accommodative as a result of climate and weather shifts.

Bonnefield has been working with blueberry farmers for many years and recently completed its first transaction with a leading British Columbia-based grower of raspberries, as we continue to ensure our farmland portfolios reflect the diversification of the Canadian agricultural landscape. Below we break down some of the key differences between row crops and permanent crops and how changing growing conditions may impact the future economics of agriculture in Canada.

Row Crops vs. Permanent Crops – What’s the Difference?

The terms “row crops” and “permanent crops” may be unfamiliar to some. An easy way to distinguish between the two is to think about a permanent crop as one that does not require annual replanting. Examples of permanent crops in Canada can include apples, blueberries and grapes. In each of these instances, fruit is produced for multiple years on the same plant (biological asset). Row crops, on the other hand, are seeded annually (i.e. wheat, canola, barley, corn, etc.).

The risk profile of permanent and row crops varies due to the fact that permanent crops rely on the biological asset’s survival through the winter months and potentially volatile weather conditions through the entire year, over the course of several years. Permanent crops also tend to be more labour-intensive than row crops, requiring greater inputs from a time and materials perspective.

The demand and end-market profile for row crops and permanent crops also tend to be different. Due to a shorter shelf life a larger percentage of permanent crops are sold into local markets. In addition, demand for permanent crops depends more on consumer preference than demand for row crops does. For example, certain varietals of berries and apples are more popular today than they were a decade ago as end consumers’ size and flavour preferences have changed. Conversely, demand for row crops is driven by a variety of macro-factors such as global production and supply levels for key crops such as wheat and soy, as well as continued global population growth. As row crops are more likely than permanent crops to be processed prior to human consumption – for example, the milling and refining of flour prior to its use in producing baked goods – consumer preferences generally have less of a direct impact on overall demand.

Permanent Crops in Canada

Canada has not historically been known as a major grower of permanent crops. While approximately 34% of all Canadian farms were reported as oilseed and grain farming operations, just 4% were fruit and tree nut farming operations per Statistics Canada’s 2021 Census of Agriculture(1).

However, we are seeing a wider range of cultivars now available as a result of favourable climate impacts on Canadian agriculture. Historically, harsh winters have limited permanent crop production in Canada as permanent crops, which are harvested from trees, shrubs or vines that do not need to be replanted each year, generally require milder conditions to protect the plant through the winter months.

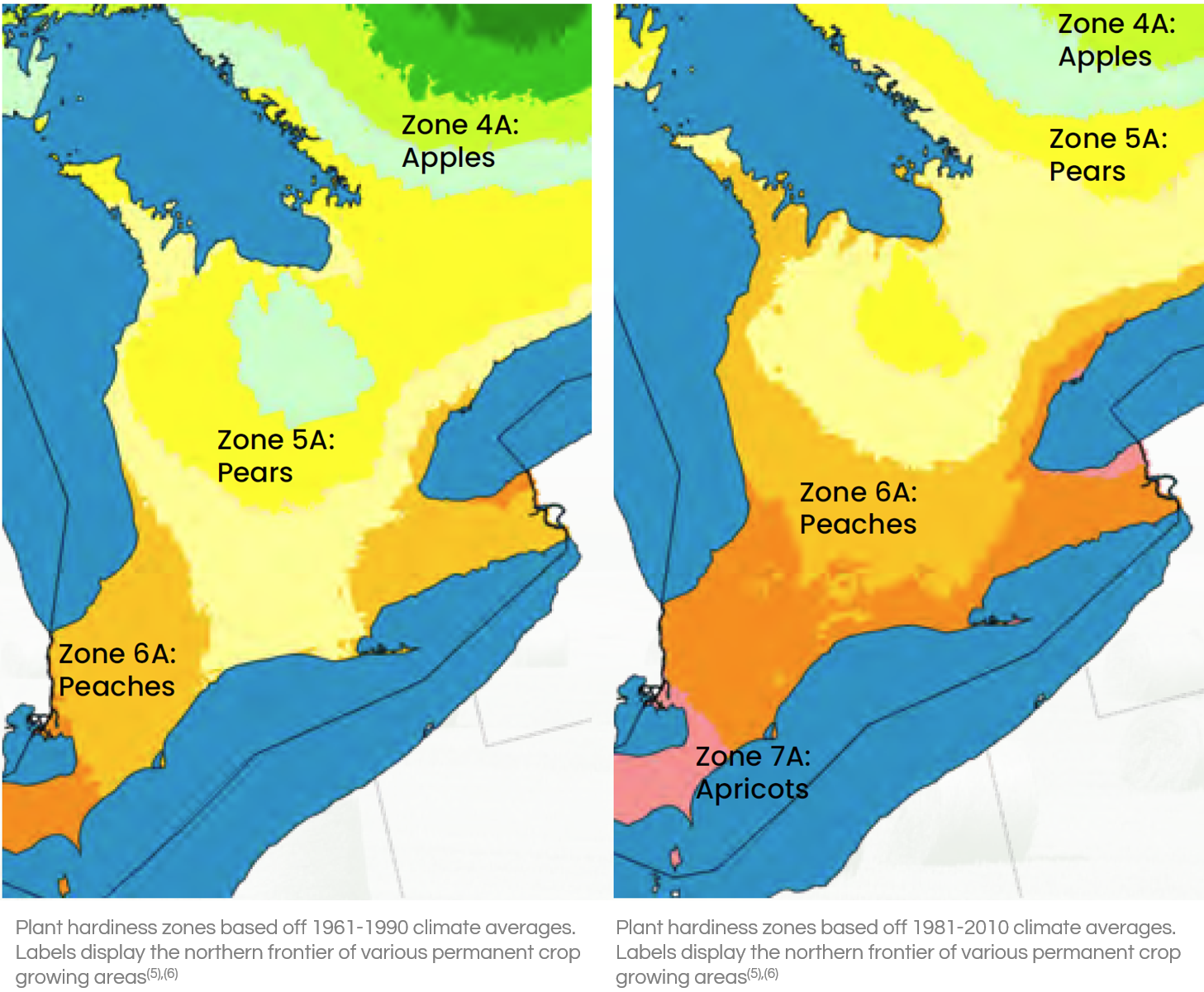

Producers use the Canadian Plant Hardiness Zone Mapping system to predict winter survival rates for their crops and, in 2010, these maps were re-drawn to reflect changing climatic conditions. The updated maps show a substantial northward migration of historical growing regions, and academic studies predict continued northward expansion of land suitable for growing warm weather permanent crops(2)(3). This change is exciting for Canadian farmers as permanent crops that have historically been grown in warmer, more southern parts of North America tend to command higher prices, which drive increased farm revenues and, ultimately, higher farmland values(4).

Bonnefield’s Experience

As previously mentioned, Bonnefield works with a number of leading permanent crop growers across Canada. We currently support apple, blueberry and raspberry producers through our alternative farmland financing solutions, and we continue to evaluate new varietals and growing regions in order to broaden our scope across the industry.

From our perspective, exposure to permanent crops offers valuable diversification that both de-risks our activities and provides us with exposure to farm operators with different and higher cash-flowing economic models than many traditional row croppers. While a single, standalone transaction in a permanent crop farm would likely demonstrate meaningful volatility and thus have a higher overall level of risk compared to a row crop operation, Bonnefield’s ability to complement exposure to permanent crops with a solid base of row crop investments creates an attractive risk/return profile for our holdings overall.

Additionally, our experience working with diversified permanent crop producers in Canada has further highlighted for us the benefit to being in Canada versus other parts of the globe. We all recognize that California has historically been a leading producer of high value permanent crops and a leading agricultural region. However, ongoing water shortages create significant strain on the industry and increasing heat units create risk for harsh growing conditions, and increased pest and disease prevalence. This increases the cost of operating in the region and enhances its volatility profile. Canada, on the other hand, has significant access to water resources and more moderate growing conditions. Our ability to grow varied permanent crop types is increasing which offers Canadian farm operators valuable optionality in their crop choices. Bonnefield is proud to be able to support these farmers throughout their business life cycle as we work towards the common goal of a strong and resilient Canadian agricultural industry.

About Bonnefield Financial

Bonnefield is the foremost provider of land-lease financing for farmers in Canada. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers to provide farmland leasing solutions to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long term future of Canadian agriculture. www.bonnefield.com

Contributing Authors:

Christian Eisenhauer

Associate

Jaime Gentles, CFA

Senior Principal

Lauren Michell

Senior Principal

Sources:

(1) Statistics Canada. Table 32-10-0166-01 Farms classified by farm type, Census of Agriculture historical data

(2) Rochette, P. (2004) Climate Change and Winter Damage to Fruit Trees in Eastern Canada, Canadian Journal of Plant Science

(3) McKenney, D. (2014). Change and Evolution in the Plant Hardiness Zones of Canada, Oxford BioScience

(4) Mailvaganam, S. (2017) Area, Production and Farm Value of Specified Commercial Fruit Crops, Ontario 2015-2016, Ontario Ministry of Agriculture, Food and Rural Affairs

(5) (2021) Plant Hardiness Zones, Natural Resources Canada

(6) (2022) Canadian Plant Hardiness Zones, Upper Canada Growers

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment.