Download PDF

Investing in Canadian Agri-Business

Bonnefield has always been a strong supporter of Canadian agriculture. For over a decade we have worked with farmers across the country to grow their operations, transition to the next generation, or stabilize and strengthen their balance sheets through a flexible land-based capital solution. Over this time, we have heard from many others interested to understand how Bonnefield could also support their businesses beyond farmland. Not only does this represent a natural extension of our existing farmland investment activities, but it is also in keeping with our commitment to the future of Canadian agriculture to find a way to support these operators. For this reason, we are launching a new investment vehicle, the Bonnefield Integrated Agriculture Fund, with a mandate to invest in agri-businesses and on-farm infrastructure via non-controlling capital for leading operators.

When we think of food production in Canada, the focus is often on primary production, particularly crop and livestock farming, or on the manufacturing and sale of finished products such as baked goods, shelf-stable products, bottled beverages, packaged fresh and frozen produce, and other readily consumable items that are available at most food retailers. However, there are a number of integral steps between primary production and the sale of finished products to consumers. The journey that our food takes from field to plate is complex and, while each part of the agri-business value chain faces unique challenges, we believe that there is significant opportunity and need for investment and growth in this sector.

A Primer on Canada’s Agri-Business Value Chain

Food production begins with primary agriculture, which encompasses the core activities that are performed within the boundaries of farms, nurseries, or greenhouses(1). Primary agriculture can include growing and harvesting crops (e.g., grains, fruits, vegetables), dairy farming, raising livestock and poultry, and aquaculture.

After food leaves the farm, processors transform raw food inputs into products and by-products that are either finished and ready to consume (e.g., milk, meat, packaged fruit and vegetables) or are then used in further value-added processing to create other goods (e.g., oils, flours, extracted proteins). Most of the food that we eat must be processed in some way prior to consumption. To take a simple example: wheat must be grown, harvested, graded (inspected and assessed for quality), cleaned, dried, ground, packaged, and shipped before it can be used to make food products such as bread.

Storage and logistics also play a fundamental role through the entire process, ensuring that food products are held safely, available for use, and able to move efficiently on to the next buyer or consumer. Grain storage and elevators, terminals, warehouses, cold storage and transloading facilities, and third-party transport providers (including trucks and railways) are a few notable examples of additional services and infrastructure that are necessary for food products to ultimately reach end consumers. These functions are essential in ensuring that Canadian food products are able to reliably reach domestic and international end markets. Notably, Canada is a major exporter of food to countries around the world and is expected to play an increasingly major role as climate change continues to affect where food is produced around the world in the coming decades.

Toward the far end of the value chain lies food distribution and retailing, and the foodservice industry. Wholesalers, grocery stores, diversified retailers, convenience stores, specialty retailers, and restaurants represent the most frequent and consistent touchpoints that many Canadians have with the agri-business value chain.

Overview of the Canadian Agri-Business Value Chain

Food Production: A Canadian Economic Powerhouse

Canada’s agriculture and agri-food processing sector is a major driver of our country’s economy in terms of production value, job creation, and international trade. Canada’s most recent Census of Agriculture reported that there were nearly 190,000 farms across the country as of 2021 which collectively employed 241,500 individuals(2). Primary agriculture also generated approximately C$32 billion, or 1.6%, of Canada’s gross domestic product (GDP) for the year(2). The Census also reported that total farm cash receipts reached an astounding C$83.2 billion for the year, of which 57% (C$47.3 billion) was attributed to crops and 36% (C$30.0 billion) was attributed to livestock and livestock products, with the remaining portion comprised of direct payments(3).

Food and beverage processing was also a major source of production value and Canadian jobs in 2021, having generated C$33 billion, or 1.7%, of Canada’s GDP for the year and employing over 300,000 individuals(2). Food and beverage processing also represented the single largest manufacturing industry in Canada in 2021, accounting for nearly 18% of all manufacturing-related GDP for the year(2). Interestingly, approximately 70% of all processed food and beverage products sold in Canada were manufactured by domestic producers in 2021, with half of the imported products having been manufactured in the U.S. and the remaining imported goods sourced from other countries around the world.

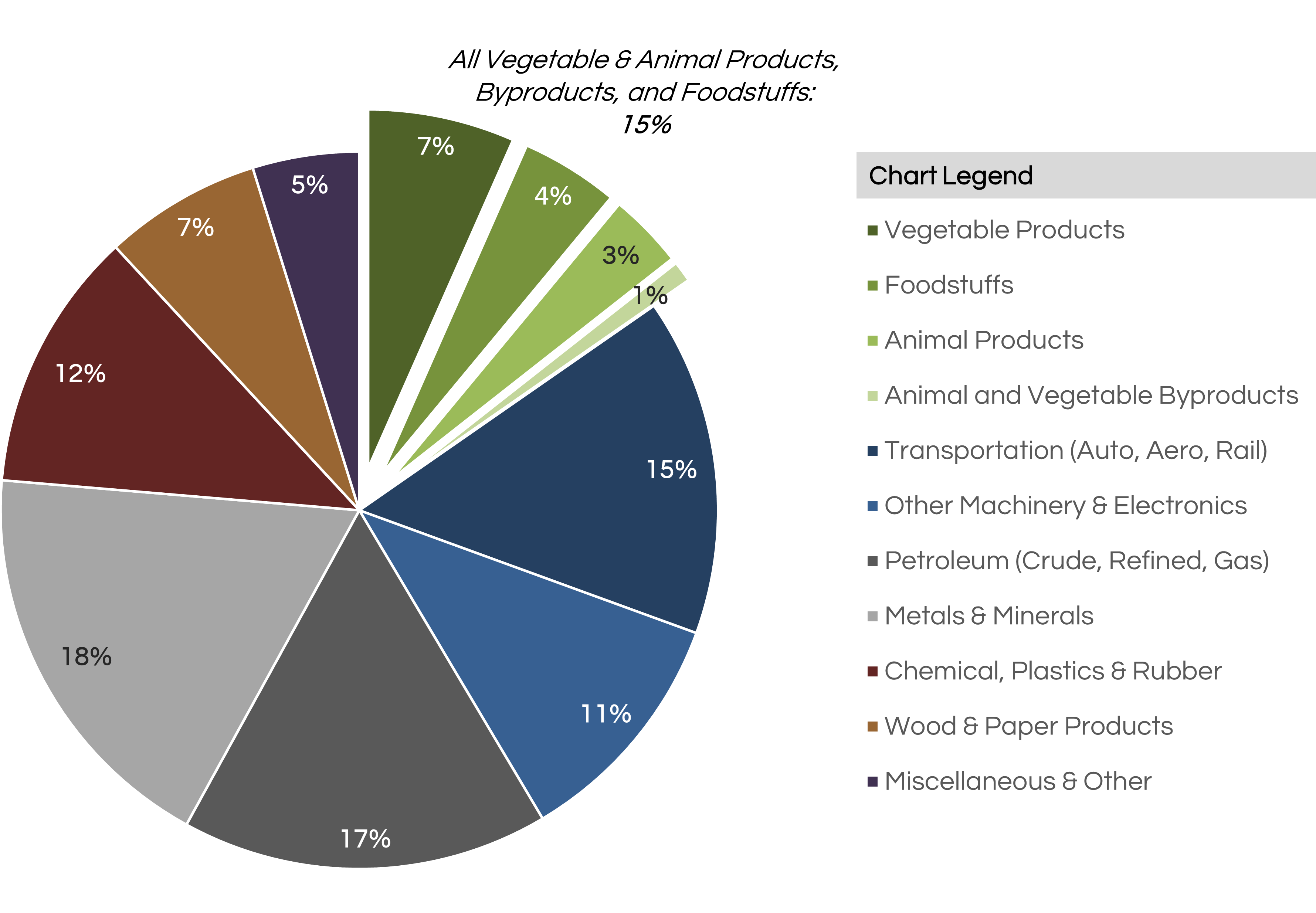

The economic importance of Canadian farming and food processing is further underscored when we look more closely at international trade. In 2020, the total trade value of all of Canada’s exports reached C$370.8 billion dollars, of which C$56.9 billion or 15.3% was attributed to collectively to vegetable products (C$24.5 billion / 6.6%), foodstuffs (16.3 billion / 4.4%), animal products including meat, cheese, eggs, and milk (C$12.5 billion / 3.4%), and animal and vegetable by-products including oils (C$3.5 billon / 0.9%).

Canadian Exports by Product Type, 2020(4)

As seen above, the aggregate trade value of Canadian food exports rivalled the value of exports from several other natural resource sectors including oil & gas and the extraction of minerals and metals, as well as the export of automobiles, airplanes, and locomotive equipment.

The strength of Canada’s agri-business sector relies on a functional, efficient value chain that extends from primary food production through to distribution, whether to domestic or international end markets. As discussed in Bonnefield’s most recent White Paper exploring the effects of climate change on global agriculture, we believe that Canadian food production will prove to be increasingly important over the near- to mid-term as the effects of climate change begin to affect food production elsewhere in the world.

As Canadian production of certain food products, such as crops, fruit, and vegetables stands to increase due to favourable shifts in climactic conditions over the coming decades, we believe that major investment in increasing processing capacity and technology, along with storage and transportation infrastructure, will also be necessary as we look to the future.

A Need for Capital…

According to a 2018 study conducted by Canada’s Economic Strategy Tables discussing the state and goals of the country’s agri-food sector, Canada had 11,499 food and beverage processing establishments in 2017 of which 94.4% were small operations with fewer than 99 employees(5). Additionally, capital investment in the food processing industry, particularly machinery and equipment, as a percentage of sales dwindled from 2.3% in 1998 to just 1.2% in 2016, and R&D expenditures in the Canadian agri-food sector as a percentage of sales fell by 24% between 2008 and 2016(5). This suggests that there has been a sustained under-investment in Canada’s food and beverage processing industry that needs to be addressed.

Finally, the report indicates that the investments that have been made in food processing innovation were fragmented across educational institutions, food technology centres, research centres and locally focused incubators(5). While these organizations play an essential role in terms of research, their scope in being able to achieve scaled commercialization is intentionally limited(5).

Just as we saw a need for alternative sources of financing in the farming industry over a decade ago, Bonnefield recognizes that Canadian agri-businesses more broadly are also limited in their access to sources of capital. These companies are often operating in manufacturing-related sectors that are capital-intensive. They require machinery, facilities, and technology – any or all of which require significant funds to acquire and implement – to compete successfully and achieve growth. Traditional debt-lending provides meaningful support to these operators but complementary, industry-specific, alternative forms of financing are lacking in the Canadian market.

… and an Attractive Investment Thesis

For those looking to gain exposure to the attractive investment attributes of agriculture, investment in Canadian agri-businesses offers an appealing option. Not only is there demand for increased investment into the sector, but Canada specifically offers unique and attractive dynamics.

Diversification: In terms of crop farming, Canada benefits from a geographic landscape, soil types, and climactic conditions across the country that result in growing conditions that are hospitable for different crop types on a regional and localized basis. For example, farmers in New Brunswick have access to land that can successfully produce potatoes, whereas farmers in the Prairies have farmland and weather conditions that better suited to row crop farming. The same is true of other agricultural products, such as dairy, wild-caught and farmed seafood, and livestock. Given the diversity of agricultural production across the country, there are many unique opportunities for businesses further along the value chain to add value through processing, packaging, storage, and transportation of Canadian farmed products. We believe that this inherent diversification gives rise to a myriad of opportunities for investors looking to deploy capital in the space.

Demand for Canadian Products: Canada’s reputation for outstanding food product safety and quality is world-renowned(5). An increasing consumer focus on food nutrition and safety, combined with a growing global population and a changing climate-driven shift in where the world’s food will be produced in the future provides a strong rationale to support the thesis that demand for Canadian-made food products will likely continue to grow over the coming decades. To meet this demand, the entire value chain – from primary producers to processors and distributors – will need to grow. Naturally, we anticipate that this will create compelling opportunities to invest in Canada’s agri-business sector, particularly around achieving scale and innovating for the future.

Supportive Regulatory Environment: The Canadian agri-business sector also benefits from a regulatory environment that seeks not only to support existing industry participants, but to grow the industry over the long-term. One example of this is the Canadian Agricultural Partnership (“CAP”) – a five-year joint investment program through which Canadian federal, provincial, and territorial governments will invest C$3 billion between 2018 and 2023 to strengthen and growth the agriculture and agri-food sector(6). The CAP encompasses initiatives, program, and funding geared toward growing trade and expanding markets, innovation and sustainable growth, and supporting diversity(6). Though this is one of many examples of Canada’s long-term practice of providing governmental support for the agriculture and agri-business industry, it still stands that the sector has seen a lack of investment in recent decades.

Bonnefield’s Role

As Canada’s leading provider of supportive, flexible sale-leaseback financing solutions for Canadian farmers, Bonnefield has heard time and again from our farmers and network of business partners that there is a distinct need for investment in the Canadian agri-business value chain beyond the farm gate. The launch of the Bonnefield Integrated Agriculture Fund is a major milestone for our firm that represents an opportunity to further expand our presence as a partner in agriculture by supporting leading Canadian agri-business operators. We are excited about this evolution and look forward to contributing to the ongoing strengthening and growth of Canada’s agricultural industry.

About Bonnefield Financial

Bonnefield is the foremost provider of land-lease financing for farmers in Canada. Bonnefield is dedicated to preserving farmland for farming, and the firm partners with growth-oriented farmers to provide farmland leasing solutions to help them grow, reduce debt, and finance retirement and succession. The firm’s investors are individuals and institutional investors who are committed to the long term future of Canadian agriculture. www.bonnefield.com

Sources:

(1) Agriculture & Agri-Food Canada. Overview of Canada’s Agriculture & Agri-Food Sector

(2) Agriculture & Agri-Food Canada (2022) Overview of the Sector

(3) Statistics Canada (2022). Table 32-10-0045-01 Farm Cash Receipts, Annual (x 1,000)

(4) Observatory of Economic Complexity (2022). Country Profiles: Canada, Exports (2020)

(5) Government of Canada via Innovation and Economic Development Canada (2018) Report of Canada’s Economic Strategy Tables: Agri-food

(6) Agriculture & Agri-Food Canada. Canadian Agricultural Partnership Overview

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities in any jurisdiction in which an offer or solicitation is not authorized. Any such offer is made only pursuant to relevant offering documents and subscription agreements. Bonnefield funds (the “Funds”) are currently only open to investors who meet certain eligibility requirements. The Funds will not be approved or disapproved by any securities regulatory authority. Prospective investors should rely solely on the Funds’ offering documents which outline the risk factors in making a decision to invest. No representations or warranties of any kind are intended or should be inferred with respect to the economic return or the tax consequences from an investment in the Funds. The Funds are intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment.